As an estate settlement specialist, I work to settle estates across the entire spectrum of preparedness:

-

At one end of the spectrum are estates with no will. I have seen many variations on this difficult situation. Imagine, for example, seven children agreeing to a proposed appointment of personal representative or division of assets – and the eighth child vehemently disagreeing. Sometimes, there is a will, but the decedent never signed it.

-

At the other end of the spectrum are estates that benefit from preparation by lawyers, financial advisors, and accountants, not to mention the decedent and family members. Yet even here, with all parties desiring to help carry out a client’s wishes, troublesome matters can still crop up during estate settlement.

This article highlights five of these troublesome topics that seem especially prone to “falling through the cracks.” Lawyers may find it helpful to consider just how these problems tend to occur – such as when a client’s financial advisor has incomplete information or makes inaccurate assumptions about the lawyer’s intentions.

1. Beneficiary Designations

One of the most common – and potentially the most severe – problems in the “falling through the cracks” category is beneficiary designations. In settling estates, I see this most frequently with respect to retirement accounts and life insurance contracts and, to a lesser extent, payable-on-death bank accounts or transfer-on-death securities accounts. But, as a potential problem, beneficiary designations are pitfalls any time an account is contractual.

Diem T. Nguyen, Notre Dame 1992, is vice president-manager of personal trust at Prairie Trust, a division of Waukesha State Bank, Oconomowoc. (262) 953-2439.

Diem T. Nguyen, Notre Dame 1992, is vice president-manager of personal trust at Prairie Trust, a division of Waukesha State Bank, Oconomowoc. (262) 953-2439.

The classic nightmare scenario is divorce, in which a decedent failed to remove an ex-spouse as beneficiary despite remarrying. Clients might assume the divorce decree, which includes such items as the division of assets, eliminates the need to notify a retirement plan sponsor or individual retirement account (IRA) custodian to change the beneficiary designation. Fortunately, in 23 states, including Wisconsin, “revocation upon divorce” laws remove an ex-spouse from large parts of estate plans without the need for further formal action.

However, updating beneficiary designations will allow asset transfers at death to occur much more seamlessly. Review beneficiaries, at minimum, whenever there is a change in family situation, whether through divorce, death, or family addition through birth or adoption.

Say a couple has an estate plan that’s 10 years old. Imagine they are in a meeting with their financial advisor, who is helping them roll over 401(k) plans to IRAs. They are now only vaguely aware of the need to designate a trust, not their children as named individuals, as the beneficiary of retirement accounts. It’s all too easy, in this scenario, for the couple’s children to end up being listed by name, losing out on some of the carefully prepared benefits of the estate plan, such as creditor protection for those retirement-account assets.

2. Personal Property

One reason personal property can fall between the cracks is that it’s often handled via an addendum to a trust agreement. An attorney might prepare a trust, oversee its signing, and instruct the individual or couple to follow through, on their own, to fill out a blank page at the end of the document. In my experience as a settlement agent, I’ve seen many situations in which that page is never completed.

I respectfully urge lawyers to inquire about personal property provisions as part of routine estate-planning conversations. (I say the same thing to financial advisors.) It’s generally helpful to trustees to have clear and specific direction about a decedent’s wishes.

Checklist for First Estate Settlement Meeting

In my experience, the items on this list are especially helpful to attend to early in the estate settlement process. As I work to settle estates, I follow this initial list with a more comprehensive framework to further guide review and action steps. Individuals might also find this list useful for organizing their own vital information and documents.

- Location of original will (or photocopy), marital property agreement, trust agreements, and so on

- Family tree and key contacts

- Safe deposit box location and key

- Checkbooks, savings passbooks, certificate of deposit for all solely owned (decedent and spouse) and jointly owned accounts – source of funds – date of acquisition

- Statements for all securities accounts – held in name of decedent, surviving spouse, or both

- Closely held-business documents

- Life insurance policies

- Automobile titles and insurance policy

- Real estate deeds and homeowners insurance policy

- Gifts or inheritances received by decedent, spouse, or both

- Funeral bills

- Other outstanding bills

- Uncashed checks payable to decedent, spouse, or both (plus list of such checks cashed after date of death)

- Employee benefits

- Medicare number and other health insurance

- Personal property

- Income tax returns and gift tax returns

- Social Security payments

To further help ensure nothing falls through the cracks, I encourage lawyers to proactively ask clients about life changes. Because financial advisors generally meet with clients more frequently than lawyers, they often have more current information. It’s far better for clients if their lawyers are equally well informed.

3. Asset Titling

When trusts are created, often lawyers give clients “homework” to retitle assets into the name of the trust. Much too often, this doesn’t happen. As with personal property designations, I strongly encourage people to complete the process and professionals to inquire regularly whether any newly acquired assets may be “out of plan.”

4. Digital Property

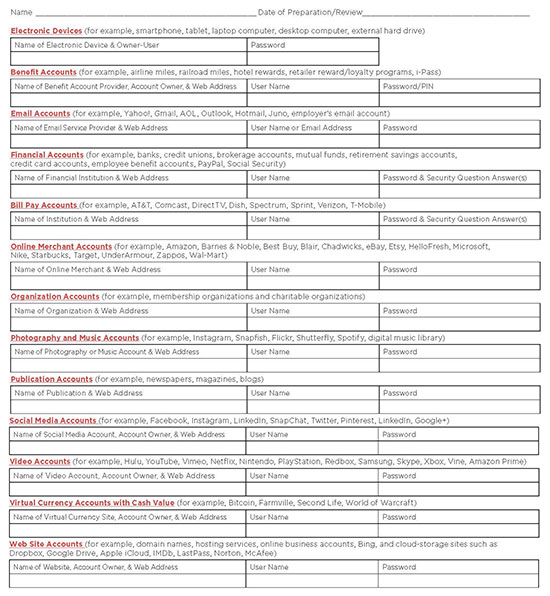

Digital property is an evolving area for estate settlement. Some people have digital assets with economic value – for example, photo or video postings that generate royalty payments or a blog that generates ad revenues. Almost everyone has digital property in the form of email accounts. How should a trustee address any or all of these? This is an area that doesn’t fall neatly into any particular professional’s domain and so it can easily fall through the cracks. (See accompanying sample digital assets inventory worksheet.)

Digital Assets Inventory Worksheet

The term “digital assets” refers to personal information that is stored electronically on either a computer or an online cloud server account that belongs to an individual. Anyone who uses email, has a password-protected cell phone, makes online purchases, or pays bills online has digital assets.

Digital assets generally require a user name, a password, or a PIN to access and can be difficult or impossible to retrieve if someone is incapacitated or passes away. Some digital assets have a monetary value while others have sentimental value. Either way, they are often very important to the people who create them.

Use this worksheet to record digital assets (for yourself or clients) by category. Then keep the worksheet in a safe place and share it with your or the client’s power of attorney, executor, and other trusted people who would need to have this information. Note that some accounts allow for two-factor authorization, so a note needs to be made about which accounts those are and how to access the second factor (for example, app on phone, card in wallet, key fob).

Click on the image above for a PDF form.

5. Payments to Creditors and Fiduciary Taxes

When someone dies, it’s necessary to settle debts, even those of the smallest kind, such as for an active newspaper subscription. Vendor arrangements must be canceled or modified. Social Security payments to the individual stop. Taxable events after someone dies must be allocated to a different entity; therefore, the trustee must obtain a new employer identification number (EIN).

This work must be accomplished, whether it’s by a personal representative under a will or by a trustee executing the provisions of a trust. Individuals and families may have preferences about how some factors in this category are addressed and may wish to prepare formal or informal guidance as part of their estate documents.

Conclusion

The five categories I’ve highlighted in this article are by no means the only areas where “best-laid plans” can go awry. The sidebars contain a short checklist I regularly use in initial estate-settlement meetings, when first studying a decedent’s documents and overall situation, and a digital assets inventory worksheet. No matter a client’s age or health, it’s never too early to engage in estate planning.

Also of Interest

Keep Your Estate Planning Knowledge Current; State Bar of Wisconsin PINNACLE® Resources Can Help

Webinar: Issues and Remedies in Inheritance Litigation 2021

Ideally, when a person dies, their family comes together and settles the assets of the estate peacefully. Unfortunately, sometimes siblings squabble, long-lost relations reappear, or former spouses claim they’re entitled to everything. Learn about several common conflicts that arise in estate litigation and find suggestions on how to remedy them.

Ideally, when a person dies, their family comes together and settles the assets of the estate peacefully. Unfortunately, sometimes siblings squabble, long-lost relations reappear, or former spouses claim they’re entitled to everything. Learn about several common conflicts that arise in estate litigation and find suggestions on how to remedy them.

1.5 CLE. View dates and register at wisbar.org/CA3141.

Member: $109 | Nonmember: $159

Book: Eckhardt’s Workbook for Wisconsin Estate Planners

Help ensure your clients’ wishes are carried out with Eckhardt’s Workbook for Wisconsin Estate Planners. This highly popular book explains a very technical area of law in an accessible way, making it a useful practice aid for all levels of experience. Counsel clients on the intricacies of estate planning, including client intake, document drafting, nonprobate transfers, wills with and without trusts, and more.

A one-stop resource packed with practical how-to approaches, Eckhardt’s Workbook for Wisconsin Estate Planners is available via the PINNACLE® subscription-based online library Books UnBound® for $190 Members | $237.50 Nonmembers. The print book is $280 Members| $350 Nonmembers.

See more details at wisbar.org/AK0047.

Meet Our Contributors

What do you do for fun?

For many years I have run outdoors to support my eating habits. When we adopted Bella the beagle from the Humane Animal Welfare Society of Waukesha County in 2011, running with her kept her from getting into trouble. Together we have logged many miles in all kinds of weather. Recently, Bella was diagnosed with undifferentiated nasal carcinoma. We pursued radiation treatments hoping to give us another year with her. Our most favorite running excursions are trail runs. To celebrate what may be the last year we have with Bella, we began a plan to run as many of the different sections of the Ice Age Trail as we can. We have completed eight and will get our Yak Trax out to trek on the snowy terrain this weekend.

For many years I have run outdoors to support my eating habits. When we adopted Bella the beagle from the Humane Animal Welfare Society of Waukesha County in 2011, running with her kept her from getting into trouble. Together we have logged many miles in all kinds of weather. Recently, Bella was diagnosed with undifferentiated nasal carcinoma. We pursued radiation treatments hoping to give us another year with her. Our most favorite running excursions are trail runs. To celebrate what may be the last year we have with Bella, we began a plan to run as many of the different sections of the Ice Age Trail as we can. We have completed eight and will get our Yak Trax out to trek on the snowy terrain this weekend.

Diem T. Nguyen, Prairie Trust, a division of Waukesha State Bank, Oconomowoc.

Become a contributor! Are you working on an interesting case? Have a practice tip to share? There are several ways to contribute to Wisconsin Lawyer. To discuss a topic idea, contact Managing Editor Karlé Lester at (800) 444-9404, ext. 6127, or email klester@wisbar.org. Check out our writing and submission guidelines.

» Cite this article: 94 Wis. Law. 14-17 (March 2021).