Now that 2020 is in full swing, the question must be asked: Do you have any new year’s resolutions? I’m not referring to the typical promises, like exercise more, eat healthier foods, or spend more time with family. Those are all good ideas, no doubt, but this is also a great time to think about how to improve your law practice – how to best serve your clients, reduce your risk of mistakes, and prevent a malpractice claim or a complaint to the Office of Lawyer Regulation (OLR).

Brian Anderson, senior claims attorney at Wisconsin Lawyers Mutual Insurance Co. (WILMIC), says that the best way, from a risk management perspective, to improve your practice procedures is to take a look back. Specifically, look at the prior year’s claims data to identify the areas of practice that placed lawyers at the greatest risk. “In addition,” he says, “it can be helpful to see what types of mistakes resulted in legal malpractice claims.”

Getting the new year off to a good start can go a long way toward a successful and prosperous 2020, so let’s review 2019 malpractice claims that came into WILMIC. This may help you determine where you might want to improve your practice in 2020.

WILMIC’s 2019 Claims Data

Anderson says, “In reviewing the legal malpractice claims that were reported to WILMIC in 2019, it appears that although the calendar year may have changed, the areas of law that were most likely to see a claim remained the same.”

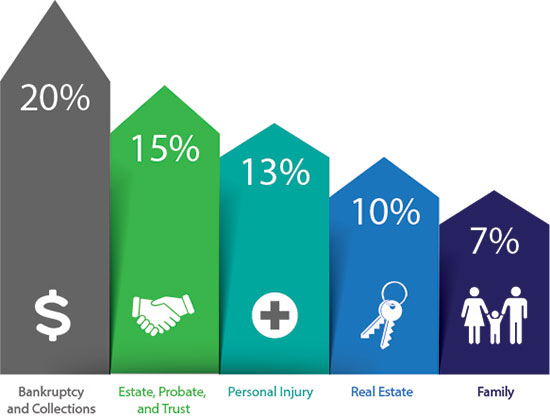

The top five riskiest areas of practice in 2019 were the following:

-

Bankruptcy/Collections/FDCPA – 20 percent of all claims

-

Estate/Probate/Trust – 15 percent of all claims

-

Plaintiff’s Personal Injury– 13 percent of all claims

-

Real Estate – 10 percent of all claims, and

-

Family Law – 7 percent of all claims.

Anderson says that these five areas of practice historically have always been the most likely to experience claims. “In addition to the frequency of claims reported in these areas of law in 2019, these areas of practice also remain expensive to insure and defend. Over 67 percent of the claim payments WILMIC paid in 2019 were generated from claims asserted against lawyers practicing in these areas of law.”

The good news, according to Anderson, is that overall, there were fewer claims reported to WILMIC last year. “In fact, we opened fewer new claims last year than in any year since 2003.”

From a risk management perspective, it is always interesting (and, I hope, helpful) to drill down into the areas receiving the most claims to examine what may have gone wrong to cause a claim to be pursued and things you can resolve to do to minimize the risk in those areas in 2020.

WILMIC’s Top 5 in 2019

A review of 2019 malpractice claims may help you determine where you might want to improve your practice in 2020. (Percent of all claims.)

Bankruptcy, Collections, and FDCPA

The area of practice for which the most claims were received in 2019 is bankruptcy, collections, and Fair Debt Collection Practices Act (FDCPA) matters. This continues the trend that WILMIC has observed in this area of practice over the last several years.

Anderson says, “Lawyers reported several first-notice lawsuits filed against them for inadvertently violating the FDCPA and Wisconsin Consumer Act when attempting to collect a debt for a client. These types of claims are often expensive to defend and can be difficult to resolve because counsel representing the claimant may be motivated to continue to litigate without any realistic settlement proposal offered in order to maximize actual attorney’s fees, which can become a part of the damages claim. The fact that these claims come from nonclients in an area of practice that is controlled by a strict liability statute is a headache for the lawyers involved. The collection practice claims that we saw weren’t the result of abusive or harassing collection acts, but rather, minor errors such as inserting the wrong amount into a letter or affidavit, not being careful about venue, or failing to comply with the required guidelines in the initial collection letter.”

According to Anderson, “We also opened several claims in 2019 where the attorney was blamed for the denial of the client’s bankruptcy discharge. The last half of 2019 saw fewer claims opened in this area of practice. Hopefully this trend will continue in 2020.”

Estate Planning

Estate, trust, and probate practice generated the second highest number of claims in 2019. Anderson notes, “In 2019, we noticed an uptick in both the claims reported and the indemnity dollars spent in the area of estate planning, compared to the previous year. This area of practice generated the highest amount of indemnity payments of any area of practice WILMIC insured last year.”

Why did WILMIC pay more in estate planning claims than any other area of practice? Anderson identified two problem issues: “first, unexpected tax ramifications negatively impacting the overall distribution of an estate and second, allegations that the lawyer failed to accomplish the client’s ‘intended distribution’ goal. The estate, trust, and probate claims last year highlight the fact that it is risky to get involved in an estate matter late in the process [and] without a full understanding of the client’s estate plan, including the various documents that may have been previously executed prior to the lawyer’s involvement.”

Lawyers reported several first-notice lawsuits filed against them for inadvertently violating the FDCPA and Wisconsin Consumer Act when attempting to collect a debt for a client.

Anderson also cautions that in the estate planning area, a disinherited third party can bring a claim against a lawyer. “Wisconsin law generally protects an attorney from a negligence claim by a nonclient by requiring the establishment of an attorney-client relationship. However, there is an exception to that rule in estate planning work that allows claims to be brought by beneficiaries and would-be beneficiaries of a decedent, who are disinherited because of an error made by the attorney. We certainly see our share of those type of claims.”

Plaintiff’s Personal Injury

The area of practice generating the third highest number of claims in 2019 involved personal injury law. Plaintiff’s personal injury practice has been by far the most expensive to resolve in terms of severity since WILMIC started doing business in 1986.

Anderson says, “Claims against lawyers practicing plaintiff personal injury law are certainly not new. Historically, this area of practice has been the most expensive area of practice to insure, in terms of the defense and indemnity dollars spent by WILMIC. One thing that did not change in 2019 is that the failure to file a personal injury claim within the required statute of limitation represented the most common error leading to claims made against lawyers practicing in this area of law. Prosecuting claims in jurisdictions outside of Wisconsin and pursuing claims against the state or government were again the most common sources resulting in claims last year.”

Anderson says another issue that tripped up lawyers practicing personal injury law in 2019 was the failure to completely resolve lien issues that affected clients’ injury claims. “When the unresolved lien claims were later asserted against the client, it resulted in a malpractice risk to their personal injury attorney.”

Real Estate

Real estate practice generated the fourth highest number of legal malpractice claims in 2019. The good news for lawyers who do real estate work is that claims in this area of practice were down last year. However, as Anderson reminds us, it is still in the top five overall.

“The most common type of claim reported in 2019 involved problems with the legal description or other important terms or conditions contained in the transfer documents. Boundary disputes, adverse possession, or easement issues can usually be avoided if the parties obtain a title opinion prior to the closing. Delay damages and additional fees or costs to allow the underlying transaction to close caused by this type of an error will ultimately be asserted against the attorney or the title company.”

Clear communication with clients at all stages of the representation is not merely good customer service; it might help you avoid a claim altogether in 2020.

Anderson also notes that real estate lawyers run the risk of conflict-of-interest claims. “In the past, we have seen claims in which the aggrieved party to a real estate transaction, who was not represented, later blamed the attorney for allowing his or her client to ‘take advantage’ of them. Written disclosure of exactly what your role is in the handling of the underlying transaction is of paramount importance in avoiding these types of claims or defending against them if asserted.”

Caution is also warranted regarding fraudulent activity related to wiring funds in real estate transactions. This occurs more often than you might think and remains a significant cyber threat. Although this type of fraud occurs in a variety of ways, it most often involves the interception of email communication followed by a change in the manner in which closing proceeds are delivered. For example, after intercepting an email from a party involved in a real estate transaction, a scammer may insert fraudulent wire-transfer instructions in the intercepted email and then forward those instructions to the recipient. The final recipient unknowingly wires funds to the scammer’s bank account, thinking he or she is just following the other party’s instructions.

This has happened with such regularity – sometimes involving huge sums of money – that lawyers need to be hypervigilant when communicating by email to avoid such schemes. The following practices may help prevent such losses:

-

Limit communication to previously verified contact information.

-

Use encrypted communication via a client portal.

-

Use fax, snail mail, or landline telephones to communicate wire instructions – especially to verify any changes and to confirm wire transfers.

-

Carefully check email addresses in emails that contain wiring instructions, which may change after a scammer has intercepted the communication.

-

Heighten awareness by training yourself and your staff.

Family Law

Legal malpractice claims against family law attorneys in 2019 tended to involve clients who later claimed to be displeased with the final outcome of their divorce or child custody determination, according to Anderson. “Some of the claim demands in this area of practice were primarily fee related. After the underlying representation concluded and unanticipated events developed, the client blamed the lawyer for the further costs, fees, and aggravation involved in trying to reach an amicable resolution.”

2020 Resolutions

All of this points to several resolutions that can help lawyers avoid the same pitfalls others ran into in 2019. Anderson’s advice is simple. He recommends the following:

-

Slow down.

-

Carefully review your work product.

-

Double check that your client communications are both clear and frequently provided. Clear communication with clients at all stages of the representation is not merely good customer service; it might help you avoid a claim altogether in 2020.

-

If you think you have made an error, report the issue to your legal malpractice carrier as soon as possible, both to protect your coverage and so that claim repair efforts can be explored.

Anderson adds, “Since 2000, over 60 percent of the claims reported to WILMIC ended up resolving with no claim payment paid. Proactive claim handling and claim repair are most likely to be successful when a claim concern is timely reported and communicated to the client.”