How Not to Get Sued by Disinherited Individuals

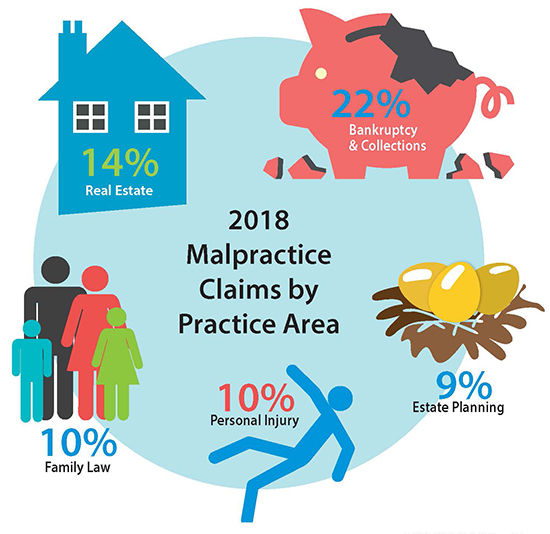

In “2018 Trends: Bankruptcy & Collections Top List” (Wisconsin Lawyer, Nov. 2018), Tom Watson examined the most common types of claims reported to Wisconsin Lawyers Mutual Insurance Co. (WILMIC) during 2018 and the riskiest areas of practice this past year. He said the areas of law that generated most of WILMIC’s claims were bankruptcy and collections, real estate, family law, plaintiffs’ personal injury work, and estate planning.

He provided some tips on how to minimize the risks of high-claim practice areas. A reader responded with a post to the Real Property, Probate & Trust Law Section elist:

Reader: The November Wisconsin Lawyer contains another reference to estate planning attorneys being sued by disinherited individuals. While I have successfully avoided any such claims, I am becoming concerned with the number of such claims by disinherited individuals.

It is not unusual in my practice to have an estate planning client disinherit a child or sibling. My standard course of action is to have two legal assistants present and taking notes during such estate planning conferences. I usually establish competency and capacity of the client in relation to the estate planning I am doing for them.

I then question the client as to the reasons for the disinheritance. The reasons for disinheritance are many. They include loss of contact, previous payments to the child at the exclusion of other children, and the lack of love and affection between the testator and the child.

I also carefully question the person as to whether they will regret their decision for eternity. I do this deliberately to confront the testator with their decision. However, there are some clients who really don’t want to provide many details for the disinheritance.

What are others doing? Any suggestions would be appreciated. I hope to avoid videotaping or recording these confidential estate planning conferences.

James J. Winiarski

James Winiarski Law Office, Milwaukee

We Want to Hear from You! Submit a Letter to the Editor

Wisconsin Lawyer provides a forum for members to express ideas, concerns, and opinions on law-related subjects. Send comments to wislawyer@wisbar.org (include “Letters” in the subject line), or mail to Wisconsin Lawyer “Letters,” P.O. Box 7158, Madison, WI 53707-7158. Limit to 500 words. Writing guidelines available.

Connect With Us Online. Post comments to articles

online, and find us on

Facebook, Twitter, and LinkedIn.

Interpreting Class Arbitration Agreements

In “Seventh Circuit Says District Court Must Reevaluate Arbitration Agreement” (InsideTrack,Nov. 6, 2018), Joe Forward reported an arbitrator awarded $10 million in damages to 174 employees in a class arbitration action for wage and hour violations originating in Wisconsin. But the U.S. Court of Appeals for the Seventh Circuit said that award must be revisited.

The U.S. District Court for the Western District of Wisconsin compelled arbitration under an arbitration clause that an employee signed with Waterstone Mortgage Corporation, but the court struck a waiver clause that prohibited class or collective claims in arbitration. That was before the U.S. Supreme Court decided Epic Systems Corp. v. Lewis (2018), in which a majority upheld the enforceability of class arbitration waivers that prevent employees from banding together in arbitration against employers.

A reader posted a comment:

Reader: The Seventh Circuit strikes a blow for an employer that cheated its workers. Lawsuits are prohibited because of arbitration laws. Now, most likely arbitration must be done worker by worker. No doubt many of the 174 employees lack the resources or the time to engage in a protracted battle over individual arbitration. What the court is saying is that employees in this situation are at the mercy of their employers. If they want to seek justice it will take a long time and cost a lot of money.

American workers are under assault from the government and the courts. Soon, everyone in the private sector will be an “at will” employee with extremely limited rights. They are barred from the courthouse; they appear to be on the verge of being barred from class-action arbitration. Bit by bit, worker rights in this country are being shredded. Soon there will be nothing left.

Nicholas C. Zales

Zales Law Office, Milwaukee

Preserving Voting Rights

Reading Mr. Martin’s essay on voting as a “sacred” and “fundamental right and duty” (Wisconsin Lawyer, Oct. 2018), I kept waiting for him to mention the GOP’s aggressive campaign to suppress the vote. Nope. Not in there. The closest Mr. Martin comes to acknowledging this cynical threat to our democracy is when he writes, “I also came to learn how for millions of fellow citizens over the history of our great nation, it had been a right often and systematically denied.” By using the past tense, he infers that the denial of the right to vote was cured by the ratification of the 15th and 19th Amendments and by the passage of the Snyder Act.

It’s mind-numbing that in 2018 one could pen an essay about our democracy and the sanctity of the right to vote and completely ignore the GOP’s widespread (and successful) efforts to disenfranchise certain groups of voters. Mr. Martin naively writes, “Each of us gets our say in the privacy of a voting booth. Whoever wins, the people have spoken.” Sounds wonderful. Shamefully, it’s not true.

Frederick “Fritz” Anderson

Duluth, Minnesota

Taxing Interstate Commerce (Notably Internet Sales)

In “Post-Wayfair: Certain Internet Sellers Must Collect, Remit Wisconsin Sales Tax” (InsideTrack, Oct. 3, 2018), Richard Latta reported that effective that week, certain retailers with online sales in Wisconsin must start collecting sales taxes, and remit sales taxes as soon as November, under an emergency rule.

The Wisconsin Department of Revenue issued an emergency rule, effective Oct. 1, 2018, requiring out-of-state internet retailers to collect and remit Wisconsin sales taxes if annual sales or transactions exceed a certain threshold amount. The emergency rule follows a recent U.S. Supreme Court decision, South Dakota v. Wayfair, in which the Court overruled previous decisions that said a state could not require an out-of-state seller to collect and remit state sales taxes on goods shipped to consumers unless the seller had a physical presence in that state.

A reader posted a comment:

Reader: Wayfair continues the deviance from the classic jurisprudence embodied in the dormant Commerce Clause doctrine. State taxation and other interference of and with interstate commerce (free transaction and exchange) was precisely the reason for the Commerce Clause, which the Rehnquist Court started eroding in the 1990s.

No such animal as “double precedent” or “precedent on precedent,” much less Justice Kennedy’s mischaracterization of Wilson, obviates the difficulty presented and sustained by Wayfair, of “necessary and proper” adherence.

Montesquieu and the Framers, including Chief Justice Marshall, are rolling in their graves, and law (the kind that does not change over time), freedom, and prosperity have been struck a blow. As in the case of Roe, the controversy will continue – separation of powers demands it.

Gordon D. Payne

Weston, Vt.

County Not Required to Pay for Criminal Actions of Jail Corrections Officer

In “Federal Appeals Court Reverses $6.7 Million Award Against Milwaukee County” (InsideTrack, Sept. 25, 2018), Joe Forward reported that the U.S. Court of Appeals for the Seventh Circuit recently reversed a $6.7 million jury award against Milwaukee County, concluding the county is not required to pay for the actions of a jail corrections officer found to have raped a female inmate.

The victim sued the officer and also sued the county for indemnification under Wis. Stat. section 895.46, which allows judgments against political subdivisions for acts by employees acting within the scope of employment. The county moved for judgment as a matter of law, but the U.S. District Court for the Eastern District of Wisconsin allowed a jury to hear the case, despite the county’s argument that the officer’s sexual assaults fell outside the scope of his employment.

The jury awarded the victim $1.7 million in compensation and $5 million in punitive damages and said the county must pay under the indemnification statute. The county appealed. In Martin v. Milwaukee County, a three-judge panel for the Seventh Circuit Court of Appeals reversed the district court.

A reader posted a comment:

Reader: The Seventh Circuit got this exactly right. In the state in which I primarily practice, any act constituting bad faith on the part of a government employee takes that act outside the scope of employment; thus, the employing government agency cannot be held liable under the Governmental Tort Claims Act. This is particularly true when, as here, the conduct complained of is a criminal act. This is different from excessive-force claims, in that law enforcement agents are actually entitled to use force in the scope of their employment, and generally, such force is implemented with the intent to serve the objectives of the employer. I was actually surprised to find that this got past the Eastern District of Wisconsin.

Timothy S. Kittle

Tulsa, Okla.