Transactional law is a vague concept, describing an amorphous collection of legal services that includes overseeing contracts and agreements related to financial exchanges, verification of documents, negotiations, and provision of general legal counsel regarding commercial transactions, intellectual property, employment, real estate transactions, mergers and acquisitions, personal estate planning services, and other matters.

When I contemplated my career after law school, I considered a transactional lawyer to be someone whose main purpose was to assist with transactions and contracts – that is, someone who stayed out of the courtroom. Some people might think that it’s riskier to work in a courtroom, a place where thinking while being peppered with questions and arguments from opposing counsel and judges would increase the likelihood of a mistake. However, recent experience at Wisconsin Lawyers Mutual Insurance Co. (WILMIC) suggests that the risk of a malpractice claim arising out of transactional work is significantly higher than in litigation – especially in estate planning.

Estate Planning is the Riskiest Transactional Work

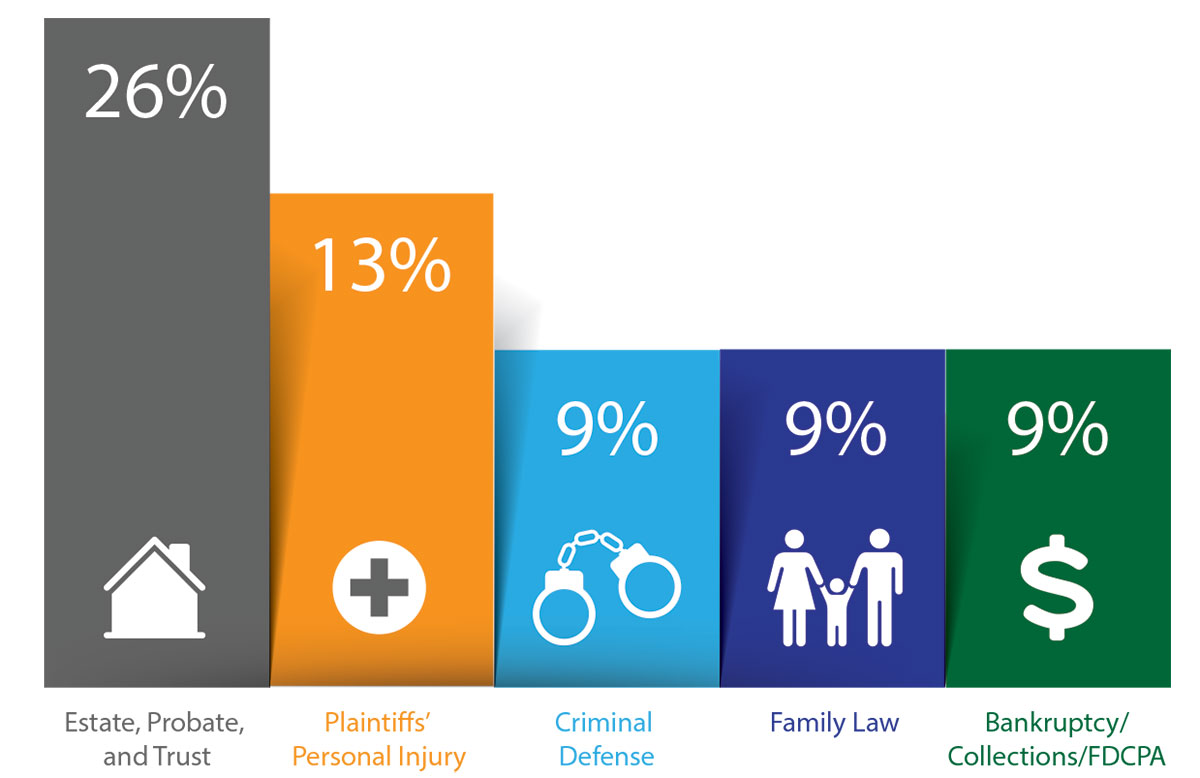

Estate planning has consistently been a high claim producer. According to Brian Anderson, WILMIC director of claims, this area has recently generated even more activity. “One area of practice that jumps off the charts, in terms of both frequency and severity last year, was the area of estate, probate, and trust,” Anderson said. “In 2022, claims against estate planning practitioners represented over 26% of the claims reported and 22% of the total indemnity dollars paid. 2022 represented the third straight year that estate, probate, and trust claims were the most frequently made. Furthermore, estate, probate, and trust was the second most expensive area of practice to resolve claims.” (See Figure 1: WILMIC’s 2022 Frequency Claims Statistics by Area of Practice.)

Reasons for the Rise in Estate Planning-Related Claims

Several types of actions during estate planning can lead clients to make complaints about their attorneys. A common complaint is a conflict of interest. It is important for lawyers to identify whom they represent and then adequately communicate this to individuals and equally important for lawyers to communicate whom they do not represent. Another thing that might lead to complaints is a lawyer’s failure to determine and advise the client of tax consequences of estate planning or a lawyer’s failure to refer the client to a tax expert or accountant. Ambiguities in drafting are also a common source of complaints – the attorney’s drafting created a dispute that leads to litigation that without the drafting ambiguity would not have occurred, and the litigation diminishes the value of the estate.

Claims that involve non-client third parties are becoming more prevalent. The attorney involved in providing estate planning services is an easy target for a disinherited beneficiary who contends that the decedent’s intended distribution was frustrated by the lawyer’s negligence. Although it is a well-established rule in Wisconsin that an attorney is not liable to a person who is not a client for “acts committed in the exercise of his [or her] duties as an attorney,” there are exceptions to this rule in the context of estate planning.1 The “Auric exception” holds that the beneficiary of a will can maintain an action against an attorney who negligently drafted or supervised the execution of a will even though the beneficiary is a third party not in privity with the attorney. In general, this exception allows a named beneficiary to sue an attorney for malpractice when the beneficiary can show that the beneficiary was harmed by the attorney’s negligence that frustrated the intent of the attorney’s client.2

Third-party claims can also affect lawyers practicing in family law, real estate, and general business transactions.

When a lawyer allegedly failed to investigate the way in which a client’s assets are titled and does not properly advise the client regarding the effect of the estate planning document or legal transaction on an intended distribution, there is fertile ground for a legal malpractice claim. Litigation costs and fees are another element of damages affecting estate planning attorneys when it can be established that litigation was “necessary” because the estate planning documents that the lawyer prepared were ambiguous.

Estate Planning Risk Management

Effective communication is crucial to avoid malpractice in any practice area, including estate planning. Among other things, Wisconsin’s Rules of Professional Conduct require lawyers to keep clients regularly informed, respond to client inquiries in a timely manner, and provide clients with sufficient information to allow the clients to make informed decisions.3

Lawyers should keep the following in mind when communicating with clients:

Candor is vital.

Communication should be straightforward and as nontechnical as possible.

Recognize each client’s level of sophistication and ability to convey and receive technical information.

Listen! Provide clients with ample opportunity to think and speak.

Show interest in clients. Be curious and ask questions.

Document everything. This might include letters of engagement; advice regarding risks and unanticipated costs; advice regarding alternative approaches and when the client chooses a course of action; status reports; and “IAY” (“I advised you…”) letters, including instructions to or from a client – especially if instructions from the client run counter to your advice.

In addition to effective communication, be sure you have the necessary time, knowledge, and skills to take on the representation. “Competence” includes not only knowing the law (legal knowledge, skill, thoroughness, and preparation) but also having adequate resources, including time, to properly handle the representation.4

Once you have had a full conversation with a client about the scope of the matter, do the following:

Gather complete information, including about family members, assets, deeds, beneficiary designations, evidence of ownership, and other relevant documentation.

To determine the fee arrangement, consider all work you will perform for the client.

Meet with the client in person and alone to be sure the client is free of undue influence.

Review all relevant documents.

Provide time and advice to the client to make recommendations about distribution of assets and heighten awareness about the powers being given to family members or others.

Stay in your lane! If a situation takes you out of your area of expertise, contact an expert.

Figure 1:

WILMIC’s 2022 Claims Statistics by Area of Practice

Other Transactional Areas of Concern

Although this article focuses on estate planning because it is the area of transactional law producing the most claims, the guidance translates to other practice areas as well. Consider the common facts that underlie many claims involving the purchase and sale of a business or real estate. The seller-client brings the lawyer into the deal in the later stages of the negotiations, after transfer documents have been drafted, and the seller-client asks the lawyer to “just look it over to make sure everything’s okay.” The lawyer notices a list of representations, including tax matters outside the lawyer’s expertise, to be made by the seller-client and advises the seller-client to strike those provisions. The seller-client wants to push the deal through with as little delay as possible. The lawyer refers to the seller-client’s accountant for approval of the representations regarding tax matters, and the deal closes.

If anything goes wrong in these types of situations, the lawyer likely will be blamed. Clients’ requests or behavior (for example, “just look it over”) might be red flags. In dealing with such matters, the lawyer should consider the following:

It’s okay to say “no,” especially when the client’s needs, expectations, or demands are out of line.

Accurately identify the client and what you are being asked to do and prepare an appropriate fee agreement.

Don’t allow yourself to be rushed to the point that you can’t properly do your job.

Be particularly careful when working for families, friends, and small businesses.

Document your advice and the importance of the decisions made by the client. An “IAY” letter confirming the client’s decision and your advice may be invaluable to both you and the client.

Be mindful of clients’ overall objectives. The methods they propose might not be the best way to reach the goals. If that’s the situation, you will likely be faulted for not discussing better paths.

When a lawyer allegedly failed to investigate the way in which a client’s assets are titled and does not properly advise the client regarding the effect of the estate planning document or legal transaction on an intended distribution, there is fertile ground for a legal malpractice claim.

Conclusion

Lawyers practicing transactional law face different risks than litigators. In recent years, those risks have resulted in a significant increase in claims – especially in estate planning. Frequent and clear communication with clients is not merely good client service; it can be the best, first step for a lawyer to avoid a claim or grievance altogether. Remember that what might seem like a “simple” transaction to a client is likely much more complex, and your eagerness to help clients should not cloud your judgment in deciding whether to assist. Maintaining your competence and following through with documentation are excellent ways to deliver legal professional services that will help avoid or defend claims down the road.

» Cite this article: 96 Wis. Law. 31-33 (June 2023).