May 4, 2022 – Members will soon receive Wisconsin Supreme Court assessments and State Bar of Wisconsin membership dues for fiscal year 2023 (July 1, 2022, to June 30, 2023). Statements will be sent in early May. These payments are due July 1, 2022.

State Bar Dues Vary By Membership Class

For FY 2023, the amount of your State Bar dues is based on your

membership classification:

- Membership dues are $272 for Active and Judicial members.

- Active New members (lawyers admitted to their first bar after April 30, 2020) and Inactive members pay half dues of $136.

- Senior Active members pay half dues of $136

- Nonvoting Judicial members pay $181.33.

- Emeritus members continue to pay no State Bar dues.

Each member may deduct the portion of their dues that pays for State Bar activities not germane to the regulation of the legal profession or improving the quality of legal services, as well as those activities which constitute direct lobbying on policy matters before the Wisconsin Legislature or the U.S. Congress. This portion of dues is also known as the

Keller dues reduction. That amount totals $8.25 for FY 2023 for Active members (amount varies by membership class).

Supreme Court Assessments: What Do They Support?

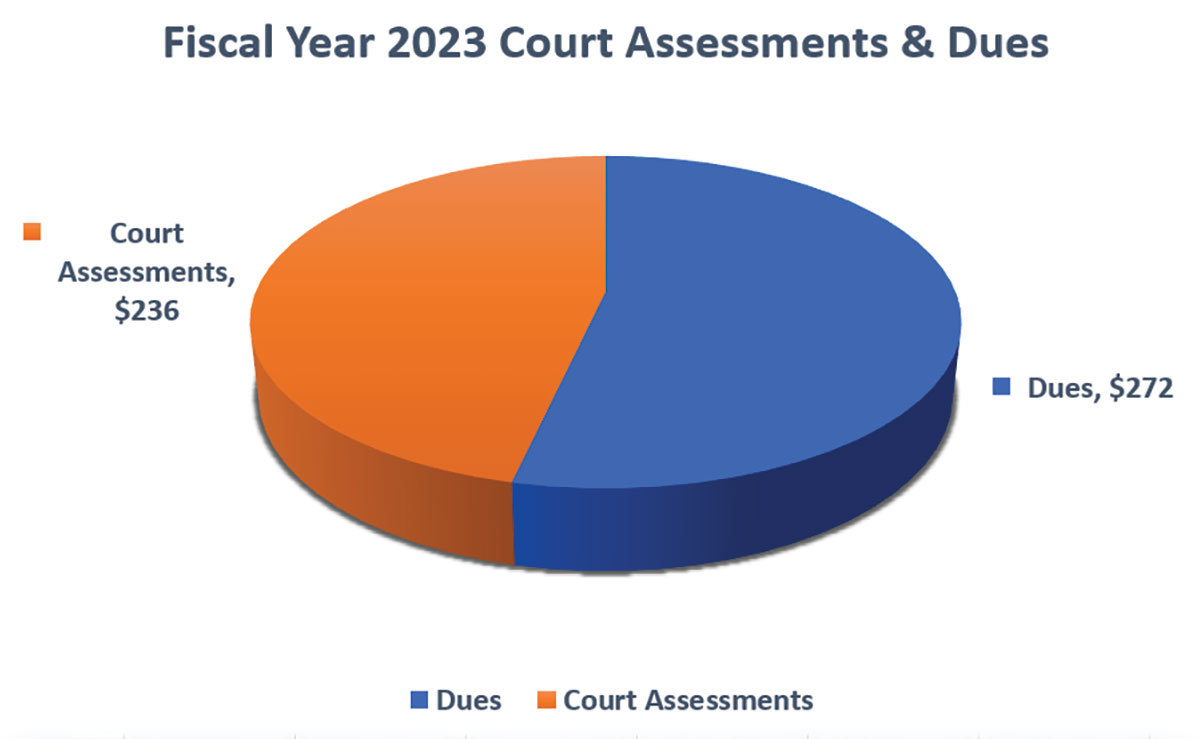

State Bar membership dues are distinct from annual assessments established and assigned by the Wisconsin Supreme Court. To assist the Supreme Court and avoid duplication of efforts, the State Bar collects court assessments in addition to your annual dues.

Court assessments for FY 2023 total $236. These assessments support the following:

* The court assesses active-licensed attorneys and judicial members $50, paid to the Wisconsin Trust Account Foundation, to fund civil legal services for people who cannot afford an attorney.

Not all member types pay the full court assessments. To find out more information, see

Maintaining Your Membership on WisBar.org.

Ways to Pay: Online, by Mail, or by Phone

Fully enrolled State Bar members in good standing may pay their court assessments and dues online, from a computer or mobile device with a credit card. For more information about paying dues online, view

FAQs: Paying Your Assessments and Dues.

Members will receive their statements via the USPS, unless they opted out of the first mailing, preferring to receive notification by email. Members who opt not to receive a paper statement will receive an email informing them that the Online Dues Portal is open, with links for access and instruction on using the portal.

Payment is due by July 1, 2022; pay by this date to avoid late fees.

Methods of payment include:

- Via a print statement received in the mail or by download at

wisbar.org/mydues;

- Online with a credit card by visiting

wisbar.org/mydues; or

- By phone in May, June, and July by calling Customer Service at (800) 728-7788.

Who Can Pay Court Assessments and Dues Online?

Fully enrolled attorneys in good standing – those who have a Bar card – may pay online.

You cannot pay your dues online if:

- You are a new member who joins on or before July 1, 2022;

- You want to change your name or membership status;

- Your membership is suspended; or

- Your office participates in the firm billing program.

After remitting payment, you can visit

myStateBar to verify that the State Bar has processed your payment. Your receipt and membership card should arrive within two weeks from the date the State Bar receives payment.

Questions? See

Membership FAQs and

Paying Your Assessments and Dues FAQs on WisBar.org or contact Customer Service at (800) 728-7788 or

service@wisbar.org.

Discover the Benefits of Membership

The State Bar is here to help you succeed. Membership comes with access to exclusive benefits – a compelling mix of products, services, and discounts that help you advance your practice and meaningfully engage with the legal community.

Products such as FastCase, a $995/year value, and the Ethics Hotline, a $300/hour value, are just two valuable resources to help members save time and money.

Advance your practice, enrich your career, and improve the quality of your personal and professional life. Take 15 minutes to

discover the benefits of membership. We’re sure you’ll find a benefit that will help you save time, money, and frustration.

Are My Dues Tax Deductible?

Supreme Court assessments and State Bar dues are not deductible as charitable contributions but may be deductible as business expenses. Internal Revenue Code section 6033(e)(1) requires certain organizations to notify members that a portion of dues is allocable to lobbying activities. We are uncertain whether the requirement applies to the State Bar of Wisconsin. If it does, your Bar card mailing will outline this percentage. See the

Dues FAQs on WisBar.org or the instructions with your mailed dues statement for more information.

If you made a donation to the Wisconsin Law Foundation or paid your Fellows pledge, these payments are 501(c)(3) charitable contributions; receipts will be issued from the Wisconsin Law Foundation.

Keep These in Mind

Here are a couple of things to keep in mind when completing the assessments and dues statement:

Please self-identify in the demographic data section. The Diversity Inclusion and Oversight Committee seeks to better understand and serve an increasingly diverse membership. Please take the time to read the insert accompanying the printed dues statement, and provide or verify demographic data collected in support of the State Bar’s commitment to diversity and inclusion.

Be sure to sign the trust account statement to retain your license – and your permanent notary commission. The Supreme Court rules require that every lawyer and judge sign this statement,

regardless of whether you maintain a trust account.

Suspensions may impact your permanent status as a notary public. Failure to accurately and timely submit the trust account statement may result in loss of permanent notary public status. The Department of Financial Institutions (DFI) may suspend permanent notary commissions of attorneys who are suspended from the practice of law. This means when you are reinstated, you must reapply for a four-year notary public commission and will continue to be reappointed in four-year increments. This matter is solely within DFI’s discretion.

Questions? Contact State Bar Customer Service at (800) 728-7788 or email

service@wisbar.org.

Remember the Wisconsin Law Foundation on Your Dues Statement

Please consider a gift to help support the

Wisconsin Law Foundation. Any level of contribution is gratefully appreciated. You can make your donation via Line 9 of your dues form.

Your support goes directly towards supporting worthy statewide programs like:

- High School Mock Trial;

- programs that enhance and support diversity in the profession;

- scholarships to assist news lawyers with debt and establishing their practice; and

- grants to innovative programs that improve the justice system.

To find out more about what the Foundation does,

read more in this issue of

InsideTrack and

see the Foundation's newsletters on WisBar.org.