On March 11, 2022, Governor Evers signed SB 104, now 2021 WI Act 160. It was published on March 12 and became effective March 13, 2022.

2021 WI Act 160 modifies

DCF 150.02(13)(a)(8) to exclude “area variable housing costs” from a service member’s income for purposes of child support. Area variable housing costs refers to Variable Housing Allowances (VHA).

VHA is one component of the Basic Housing Allowance (BAH) and reflects the local area rental market. BAH rates are based on pay grade, dependency status, and local area rental market. This means someone stationed in Honolulu, Hawaii, receives a higher VHA than someone of the same rank stationed in Barksdale, Louisiana.

Using those locations as an example, the BAH with dependents for an E-5 stationed in Honolulu in 2022 is $2,961 per month. The BAH with dependents for an E-5 stationed in Barksdale in 2022 is $1,365.

Variable Housing Allowances and Child Support

Prior to 2021 WI Act 160, the VHA was included in gross income for the purposes of calculating child support. If service members were stationed in one location when support was set then subsequently are forced to move, their VHA and ultimately BAH rates likely changed. If the BAH decreased, service members would either motion the court to modify support or continue paying the ordered amount of child support even though their pay decreased.

Excluding VHA from gross income may eliminate the need for modifications of support orders when service members move from one duty station to the next.

Calculating BAH without VHA

The trickiest part of this change is how to calculate the BAH without the VHA component.

The Leave and Earnings Statement (LES) lists a flat amount for the BAH – it does not break down the BAH to show exactly how much of the BAH is attributable to the VHA. This change to DCF 150.02(13)(a)(8) requires looking not only at the LES but also the

Non-Locality BAH Rate chart, which is updated and published each year by the Department of Defense.

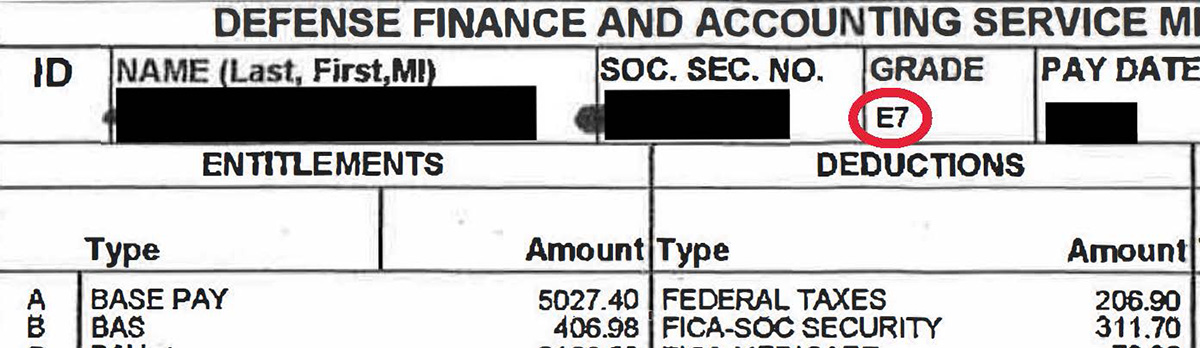

When reviewing a LES, you will need to look at the individual’s pay grade, found in the second row at the top of the LES between to the individual’s Social Security number and pay date.

For example, see

Figure 1 for an example of individual who is an E7:

Figure 1. The individual in this example has a pay grade of E7.

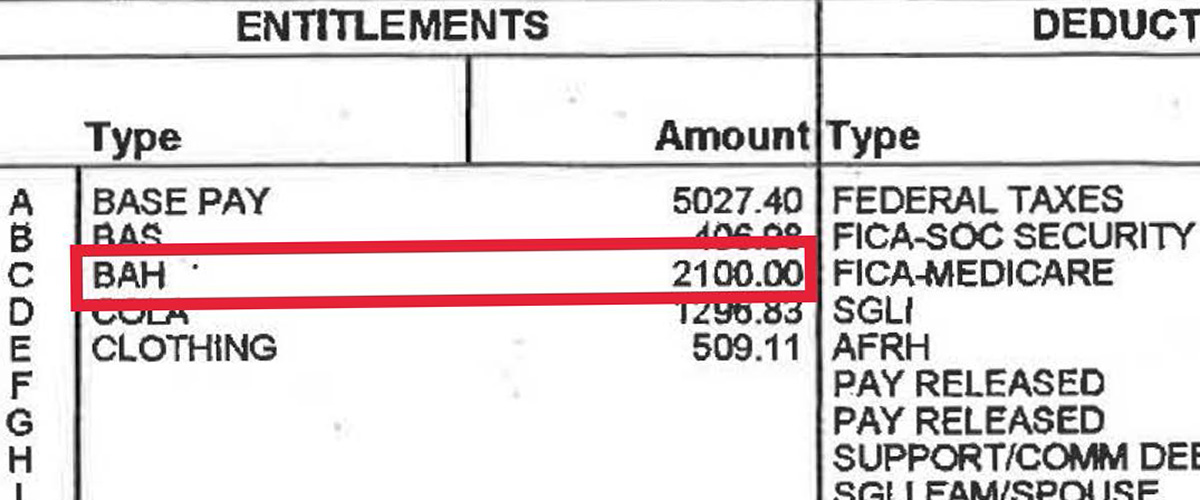

Next, find the total BAH rate, listed under “Entitlements” on the right side of the LES. This is not necessary, but it is helpful to compare the BAH listed on the LES with the applicable BAH rate on the Non-Locality BAH Rate chart. See

Figure 2.

Figure 2. Find the BAH amount under "Entitlements." In this examaple, it is $2,100.

This individual’s BAH is $2,100 per month.

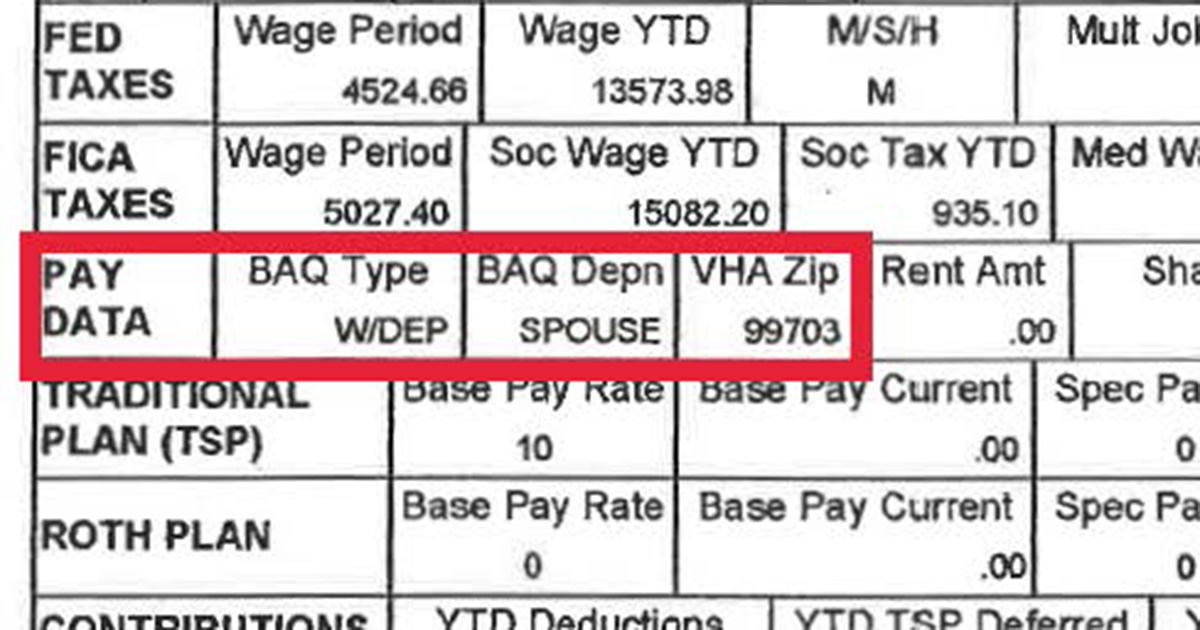

Last, look further down the LES to find the row entitled “Pay Data.” This row should have a box titled “BAQ Type,” which will indicate if pay is based on having dependents. That same row will provide the VHA ZIP code. See

Figure 3.

Figure 3. The row labeled "Pay Data" shows BAQ Type "with dependents" and VHA ZIP code of Fairbanks, Alaska.

This individual has dependents (a spouse) and is stationed in Fairbanks, Alaska.

After pulling that data, turn your attention to the Non-Locality BAH Rates chart. To find the chart you need, visit the

Department of Defense website, which provides the current year Non-Locality BAH Rates chart as well as charts from previous years. To find the chart, click on the folder entitled “Allowances,” then the folder entitled “Non-Locality_BAH.”

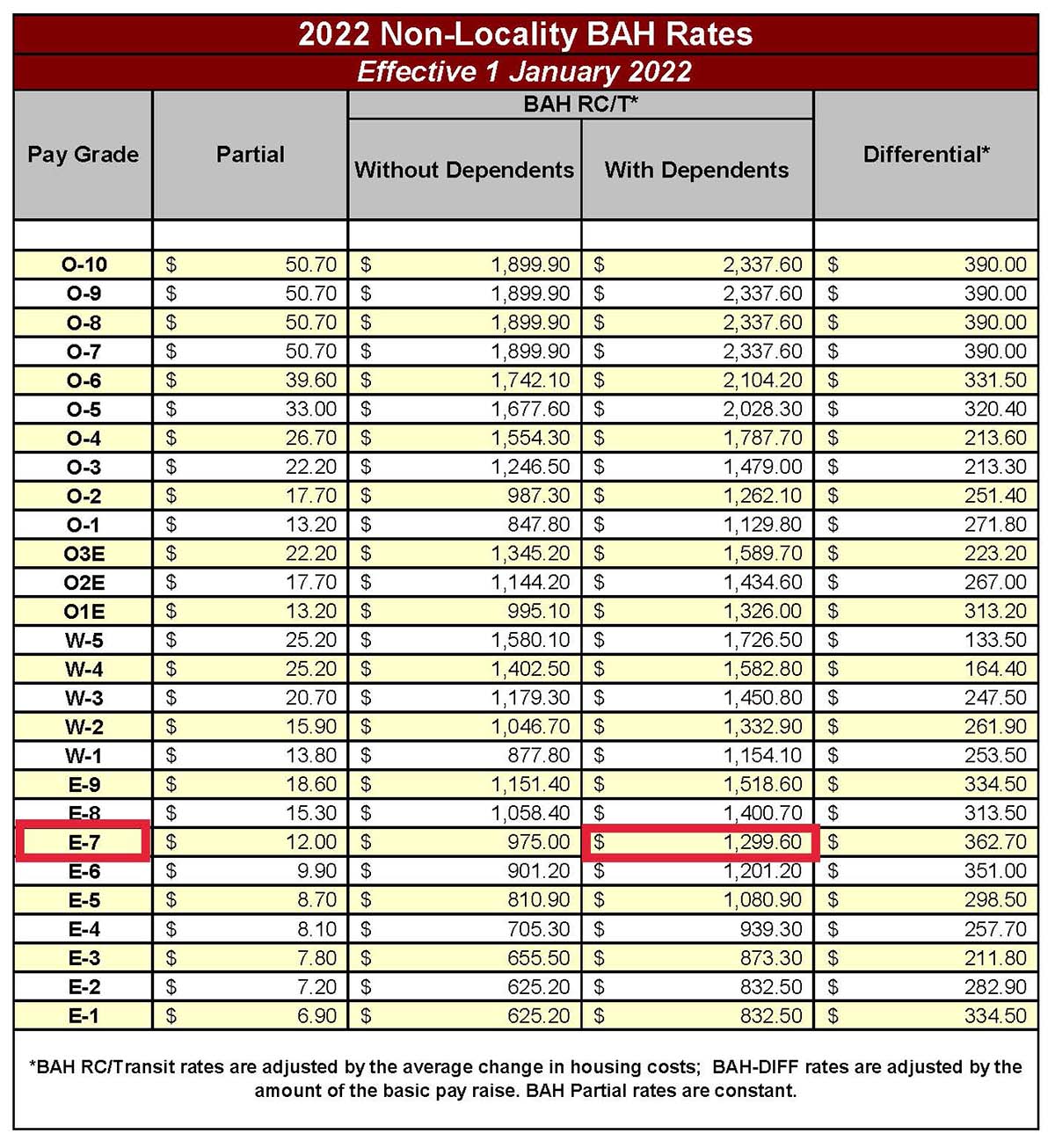

These LES extracts are from a 2022 LES, so the

2022 Non-Locality BAH Rates chart is the necessary one to review. First, find the individual’s pay grade in the left-hand column of the Non-Locality BAH Rates chart (Figure 4):

Figure 4. In this example, the BAH excluding the VHA for an E-7 is $1,299.60 per month.

Follow the row to the right to find the dollar amount listed under either the “Without Dependents” column or the “With Dependents” column. The dollar amount listed in the applicable column will be the BAH amount that should be used when calculating gross income as opposed to the BAH total that is listed on the LES.

In this example, the BAH excluding the VHA for an E-7 is $1,299.60 per month. The BAH on the LES is $2,100 per month. That is a difference of $800 per month.

You will use the $1,299.60 per month BAH total when calculating the individual’s gross income available for support.

Where to Find Out More

Military pay is complex. The exclusion of the VHA requires attorneys and courts to better understand some of the complexities.

If you are interested in learning more about active duty and reserve military pay, see the Department of Defense’s

Financial Management Regulation Volume 7A.

It’s only 1,211 pages.

More information about DCF 150 is available from Jill Mueller at (608) 422-7046 or

jill.mueller@wisconsin.gov.

This article was originally published on the State Bar of Wisconsin’s

Family Law Section Blog. Visit the State Bar

sections or the

Family Law Section web pages to learn more about the benefits of section membership.