So here we are – two-thirds through 2021, after more than a year of dealing with pandemic-related client issues, financial issues, health and safety issues, and major shifts in everyday lifestyles and habits.

Now that many people are vaccinated against COVID-19, businesses, sporting events, and other things are reopening. During a Zoom conference call recently, people were talking about getting back to something they feel is closer to “normal.” I’m not sure we’ll get back to normal completely, however you define it, but at least many of us are getting back into the office, planning to see colleagues at future conferences, returning to the courtroom, and meeting face-to-face with clients.

What does this portend for the practice of law? Let’s review what we have seen during the pandemic, what we may have learned, and what might be normal beyond the pandemic.

Most solo practitioners or lawyers in small firms I talk to think about risk management from time to time, but usually it is in the context of a case they are working on or a sticky issue they are trying to resolve. Here, I talk about risk management as a preventive measure.

Are Legal Malpractice Claims on the Rise?

First, are there any trends? If there are, Wisconsin might be bucking them. Or, probably more accurately, the really big firms in the United States have had a different experience than smaller firms, including those here in Wisconsin.

According to Insurance Journal, from 2019 to mid-2020, legal malpractice claim payouts were at an all-time high. Ames & Gough, an insurance broker, surveyed 11 legal professional liability insurers that cover 80 percent of the largest 250 law firms in the country. While the payouts were larger in 2019 and 2020, the frequency of claims remained the same.

The Insurance Journal article quotes Eileen Garczynski, senior vice president and partner at Ames & Gough: “The economic downturn from the pandemic may lead to more claims. In addition, legal malpractice risks are being compounded by adjustments in business practices made by law firms to continue serving clients during COVID-19.”

The largest number of legal malpractice claims were tied to trusts and estates, reflecting the “sheer volume of engagements involving the baby boomer generation as they continue the largest transfer of wealth in U.S. history.”

WILMIC and Wisconsin’s Experience

Matt Beier, claims attorney at Wisconsin Lawyers Mutual Insurance Co. (WILMIC), says the experience here in Wisconsin, at least for WILMIC, has been different. “Generally, WILMIC’s experience has not been consistent with the national trend of increased severity. Comparing raw numbers, 2019 indemnity payments were about 8 percent higher than WILMIC’s five-year average, and 2020 indemnity payments were about 20 percent lower than the average during that same time period. In addition, WILMIC saw a 25 percent decrease in claim frequency from 2019 to 2020. However, WILMIC has begun to see an upward trend in claims reported for the first quarter of 2021.”

Claims Up in Business and Commercial Law

One area of practice in which Wisconsin might mirror part of the national trend identified in the Ames & Gough survey is business transactions. WILMIC senior claims attorney Brian Anderson says there have been increases in both frequency and severity in practice areas that involve clients who are experiencing the most immediate effects of the pandemic.

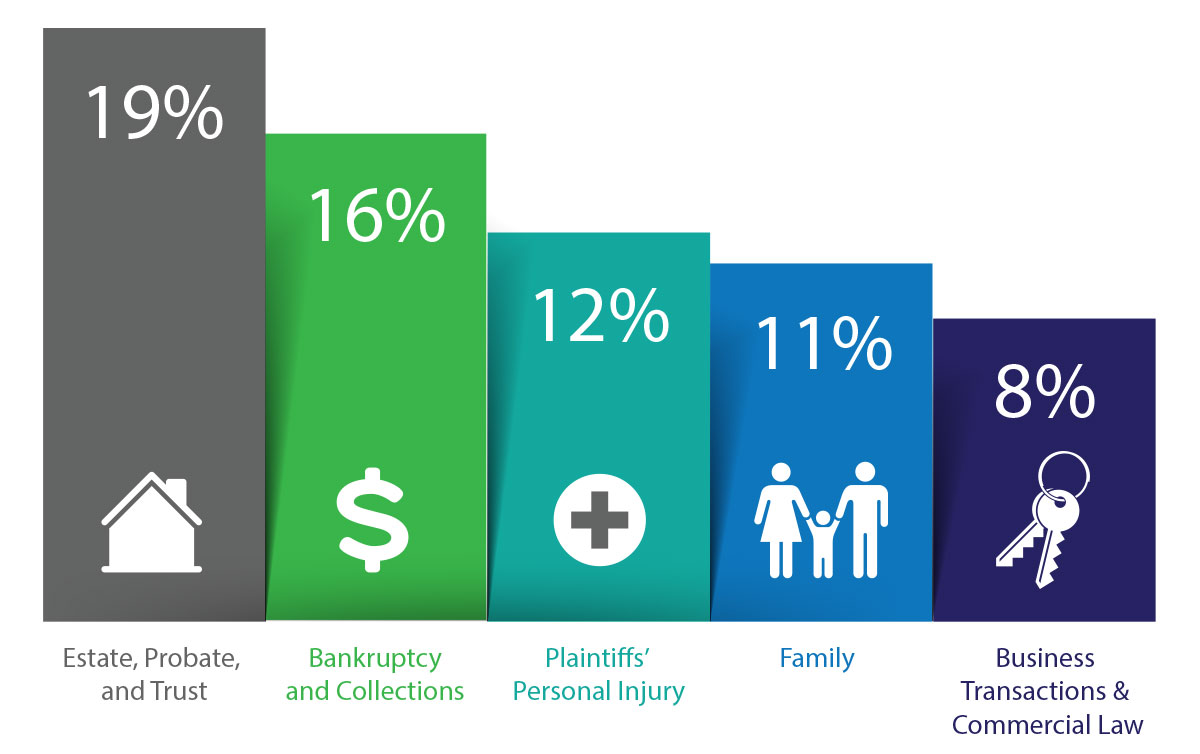

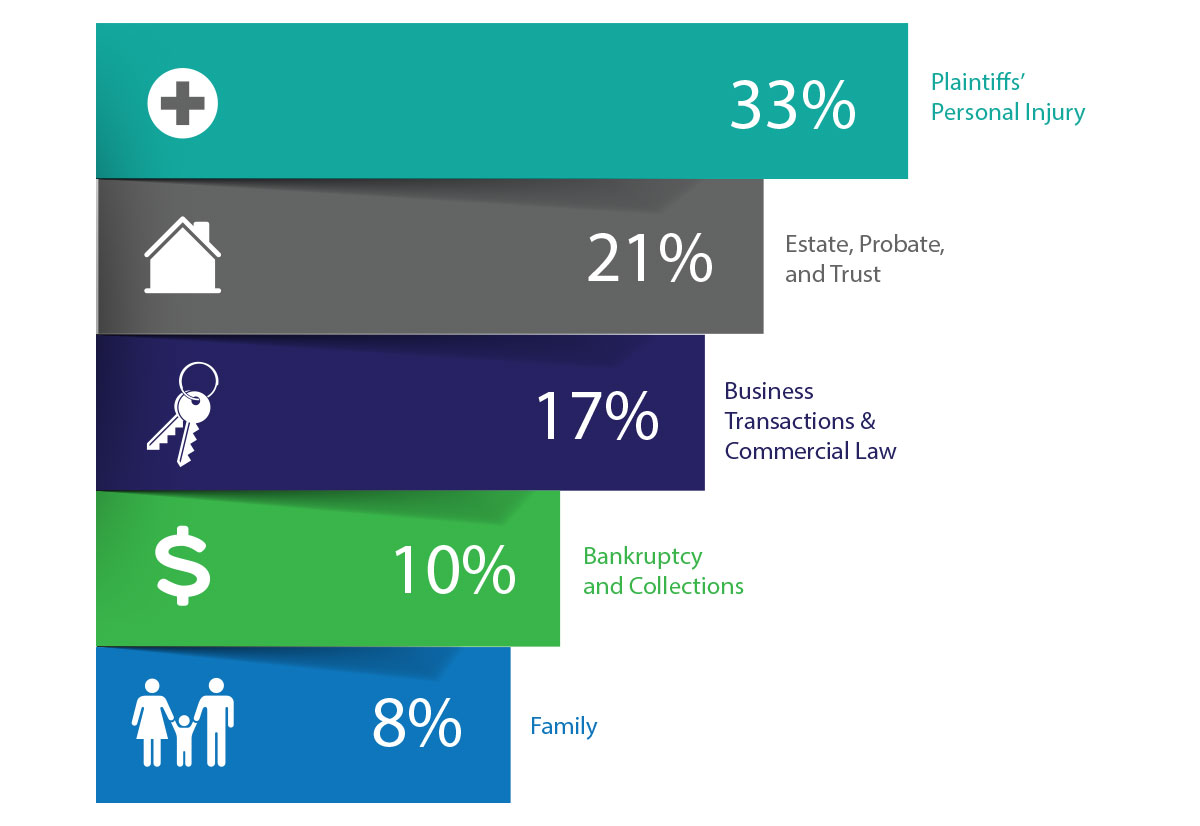

“In 2020, lawyers practicing in the area of business transactions and commercial law entered the top five areas of law receiving claims. Of greater concern is the fact that this area of practice represented over 17 percent of the indemnity dollars WILMIC paid to resolve these types of claims last year. We believe this increased-severity trend will continue in 2021. We are anticipating that lawyers practicing in the areas of business transactions and commercial law could increasingly become the target of legal malpractice claims as their clients may be forced to enter into a risky transaction, in haste, to generate short-term cash flow opportunities to maintain their business operations.” (See Figure 1: WILMIC’s 2020 Claims Statistics by Area of Practice.)

Figure 1: WILMIC's 2020 Claims Statistics by Area of Practice

Frequency

Severity

Trends in Estate Planning-related Claims

Although the largest number of legal malpractice claims nationally were tied to trusts and estates, estate planning attorney Bill Williams, Madison, says he has not seen that locally. “I have to say that I personally can’t discern any increase in malpractice claims due to the pandemic. I do wonder whether those claims are yet to come, when estate plans prepared during the pandemic ‘mature.’”

Williams does, however, recognize issues that had developed even before the pandemic. In most cases, there must be a lawyer-client relationship for a client to bring a malpractice case against the lawyer. Estate planning is one area in which there are exceptions and nonclients can bring a claim. A driver of claims activity in this practice area may stem from developments that enable third parties, such as a relative or family member, to bring a legal malpractice claim against an attorney for work performed on behalf of an elderly or sick client.

Williams says those exceptions may be expanding. “What I do see is the continuation of the trend of disappointed beneficiaries going after attorneys who drafted the estate plans. I think recent case law may expand the target attorneys to include those administering estates.”

Most Useful Risk Management Techniques

In the Ames & Gough national survey, participants were asked to list the three most useful risk management techniques for law firms to mitigate legal malpractice risk. Seven of the 11 insurers cited a well-crafted engagement agreement focusing on the scope of work as essential to avoiding risk, along with revisiting it whenever there is a change in direction of the services needed. In addition, five insurers also listed peer review and supervision of work, good client intake, and detailed communication as among the most important techniques to avoid malpractice claims.

Anderson says WILMIC’s claims experience historically has backed up the importance of good client communication. He says, “Communication mistakes account for more than 25 percent of the claims that WILMIC handles. Many of them are avoidable.” (See Figure 2: Types of Communication Errors.)

Anderson says there are some basic risk management strategies that can help. “Resolve to communicate well with your clients. Be responsive, follow up with clients when necessary, clearly identify your expectations as well as those of your clients, document your communication with your clients, and above all, speak in a language clients understand. Understanding why something is the way it is makes it easier to accept and rationalize rather than just being told that’s the way it is.”

Figure 2: Types of Communication Errors

9% – Failure to obtain consent

or to inform the client

7% – Procrastination or no

follow-up with the client

6% – Fee disputes or

misunderstandings with the client

6% – Failure to follow client

instructions

What’s Ahead?

Beier says he expects to see additional claims after the pandemic. “Looking forward, we do expect to see additional claims. Periods of economic downturn are usually followed by a rise in professional liability claims against lawyers. Financial losses for individuals and businesses increase work for lawyers, and more work results in more opportunities for errors and perceived errors. More than half of the claims we typically receive are for perceived errors, and while we pay significant defense costs for some of those claims, we do not pay indemnity costs.”

As for specific practice areas, Beier says, “Work for litigation attorneys will increase, as will work for lawyers who provide insurance and other contract construction. Real estate claims will likely rise because more real estate transactions will fail. We are already hearing of more work in the area of estate planning, and claims will inevitably arise out of the pandemic’s effect on the speed and execution manner of estate planning documents.”

Beier adds that more work is likely in the areas of bankruptcy and collections and also in immigration law. “Like bankruptcy and collections work, immigration law is very technical and deadline driven, factors which are further complicated by unstable administration, which implements rapid, sometimes daily, changes to regulations, policies, and procedures. Immigration claims will likely rise due to missed deadlines, incorrect applications, lack of communication, and failure to obtain client consent.”

As for claims overall, Beier says, “At this time, it is reasonable to estimate for an increase in claims frequency of 10 to 30 percent over the next one to three years. The effect on claim severity is more difficult to estimate as the value of clients’ assets is reduced in the economic downturn. For 2020, we estimate loss and loss adjustment costs to be slightly higher than our five-year average for those costs, although we do not expect to see all those losses in the next 12 months.”

Conclusion

Life and work have been incredibly unpredictable during the pandemic. As we settle into old routines – and certainly create some new ones that are here to stay – we can begin to assess the immediate and long-term risks associated with the pandemic. Hopefully, we will all be in a position to better manage our professional lives to avoid some of the pitfalls we have seen in the past as well as those that might appear in the future.

Ask Us!

Questions about ethics

or practice management?

Confidential assistance is a

phone call or click away:

Ethics Hotline:

(800) 254-9154, or

(608) 229-2017

9 a.m. to 4 p.m., Monday

through Friday.

Practice411™:

(800) 957-4670, or practicehelp@wisbar.org

» Cite this article: 94 Wis. Law. 47-49 (September 2021).