Large solar energy facilities, which provide a source of clean, renewable electricity, are booming in Wisconsin.1 In early 2019, Governor Tony Evers proposed that Wisconsin’s electric utilities be required to be carbon free by 2050,2 and some of the state’s largest utilities have already taken steps that are aligned with that goal.3 Indeed, over the past year alone, the Public Service Commission of Wisconsin (PSC) approved solar energy projects representing approximately 30 times the amount of solar energy generation that existed in 2018, with several more projects still in development.

This article explores the legal and practical issues associated with the oncoming increase in solar energy, how solar projects are developed and financed, and the risks and opportunities solar energy presents for landowners, energy developers, regulated utilities, local communities, and the state as a whole.

The Current State of Solar Energy in Wisconsin

Let’s be honest: At the moment, Wisconsin is hardly the sunshine state. In 2016, out of about 19,000 megawatts of total generation, there were only 2.6 megawatts of solar facilities operated by electricity providers, compared to more than 15,000 megawatts of coal and natural gas-fired electric generation.4 For perspective, one megawatt of solar energy is enough to power about 150-190 homes in Wisconsin.5

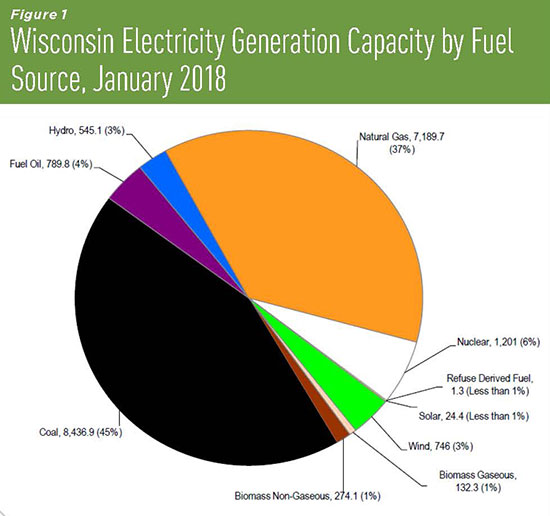

But there is a ray of hope for solar. By 2018, there were about 24 megawatts of solar facilities installed in the state – still small, but a clear increase over 2016.6 (See Figure 1: Wisconsin Electricity Generation Capacity by Fuel Source.) As of Nov. 1, 2020, there were anywhere from 2,100 to 6,700 megawatts of solar projects, ranging in size from 20 to 300 megawatts each, at various stages of planning and development in Wisconsin.7 Although it is unclear whether all those projects will be built, they represent significantly more than the natural gas combined cycle capacity that is planned for the state (just about 400 megawatts, as of Nov. 1, 2020), indicating a significant shift away from fossil fuels.8

Why Solar, Why Now?

Two key factors are driving the expansion of solar energy in the United States, including in Wisconsin: the rapidly declining costs of manufacturing solar panels and the availability of federal tax incentives.

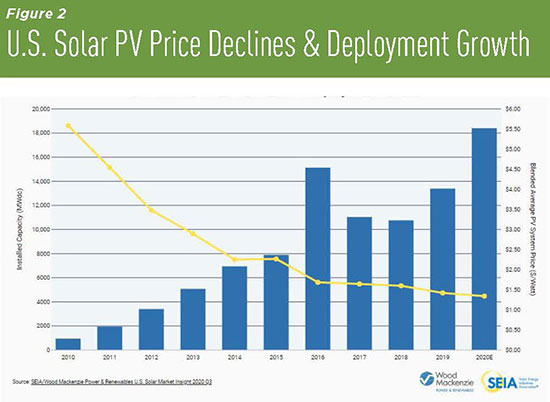

First, since 2010, the price of solar panels, which make up the most significant portion of the cost of a solar project, has declined dramatically, increasing solar deployment nationally.9 (See Figure 2: U.S. Solar PV Price Declines & Deployment Growth.)

Second, the federal investment tax credit (ITC), most recently extended by Congress in 2015, can offset as much as 30 percent of the total cost of the “energy property” comprising the solar project.10 Eligibility for the 30 percent ITC requires that the project “begin construction” before the end of 2019 through either the “physical work” test (by starting “physical work of a significant nature” under IRS guidelines) or the “five percent safe harbor” test (by acquiring a certain number of solar equipment components equal to at least 5 percent of the total cost of the energy property).11 Solar projects that begin construction in 2019, 2020, or 2021 must be continuously constructed and placed in service before Jan. 1, 2024.12 However, the ITC gradually declines from 30 percent (for solar projects that begin construction in 2019) to 26 percent for projects that begin construction in 2020, and 22 percent for projects in 2021.13 The ITC finally steps down to 10 percent for solar projects that begin construction before 2022 but that are not placed in service before Jan. 1, 2024, and for projects that begin construction after Dec. 31, 2021.14 However, even that lower tax credit remains a significant incentive to construct more solar energy projects.

Connecting to the Grid

Of all issues that define the viability of a potential large-scale solar project, none exceed the importance of cost-effective interconnection, that is, cheaply connecting the project to a regional electric transmission system. Wisconsin is included in the Midcontinent Independent System Operator (MISO), which regulates the flow of electricity across an interconnected “highway” of high-voltage transmission lines built and operated by transmission companies in the central United States.15 To ensure the safety and reliability of the grid, MISO requires a detailed and lengthy application process for developers seeking to connect new generation to the transmission system.16

Andrew C. Hanson, Lewis & Clark 2001, of Perkins Coie LLP, Madison, is a partner in the firm’s Environmental & Natural Resources practice, where he has been involved in negotiating contracts and seeking regulatory approvals for hundreds of millions of dollars of investments in renewable energy projects, energy efficiency and demand response programs, electric vehicle infrastructure, advance metering infrastructure, grid modernization and other emerging technologies in the energy sector.

Andrew C. Hanson, Lewis & Clark 2001, of Perkins Coie LLP, Madison, is a partner in the firm’s Environmental & Natural Resources practice, where he has been involved in negotiating contracts and seeking regulatory approvals for hundreds of millions of dollars of investments in renewable energy projects, energy efficiency and demand response programs, electric vehicle infrastructure, advance metering infrastructure, grid modernization and other emerging technologies in the energy sector.

Mary N. Beall, Minnesota 2018, Perkins Coie LLP, Madison, practices in energy and environmental and natural resources law helping clients navigate administrative proceedings, complex litigation, and energy and infrastructure project development. She has experience securing regulatory approval for renewable energy and grid modernization projects. Beall also counsels clients regarding compliance issues under the Clean Air Act.

Mary N. Beall, Minnesota 2018, Perkins Coie LLP, Madison, practices in energy and environmental and natural resources law helping clients navigate administrative proceedings, complex litigation, and energy and infrastructure project development. She has experience securing regulatory approval for renewable energy and grid modernization projects. Beall also counsels clients regarding compliance issues under the Clean Air Act.

Jonathan Jimenez, Univ. of Southern California 2018, Perkins Coie LLP, Los Angeles, practices in real estate and land use, managing title, survey, land use and zoning due diligence, and other complex due diligence for utility-scale renewable energy and other projects across the country. He assists energy companies with solar option and lease agreements, easements, subordinations, waivers, affidavits, and right-of-way easements. He also helps lenders with various financing transactions.

Jonathan Jimenez, Univ. of Southern California 2018, Perkins Coie LLP, Los Angeles, practices in real estate and land use, managing title, survey, land use and zoning due diligence, and other complex due diligence for utility-scale renewable energy and other projects across the country. He assists energy companies with solar option and lease agreements, easements, subordinations, waivers, affidavits, and right-of-way easements. He also helps lenders with various financing transactions.

Jared E. Padway, U.W. 2018, Perkins Coie LLP, Madison, practices in energy and public utilities regulation. He has represented generation and transmission utilities before the Public Service Commission of Wisconsin, the Western District of Wisconsin, and the Seventh Circuit. He previously counseled institutional lenders regarding the environmental risks of tax-equity financing in renewable energy transactions at Foley & Lardner LLP. He also counsels clients regarding compliance issues under major energy and environmental statutes.

Jared E. Padway, U.W. 2018, Perkins Coie LLP, Madison, practices in energy and public utilities regulation. He has represented generation and transmission utilities before the Public Service Commission of Wisconsin, the Western District of Wisconsin, and the Seventh Circuit. He previously counseled institutional lenders regarding the environmental risks of tax-equity financing in renewable energy transactions at Foley & Lardner LLP. He also counsels clients regarding compliance issues under major energy and environmental statutes.

MISO’s interconnection process for new power plants (including solar) is complex, but in simplest terms, MISO 1) helps identify and determine the available physical locations at which an energy project can feasibly interconnect to the transmission system (the “point of interconnection”) and 2) analyzes the need for any upgrades to the transmission network needed to carry the megawatts from the project without overloading the system.

Point of Interconnection. The point of interconnection – the physical location where the project can tie into the grid – naturally influences the location of the project. MISO requires that solar developers seeking interconnection rights acquire and maintain land rights of at least five acres per megawatt of solar, and also acquire land rights for the proposed “generator tie line” and collector substation that will connect the project to the grid.17 As a result, and to minimize risk, developers often seek land rights near an existing transmission line or transmission utility substation, which minimizes the need for a lengthy and expensive generator tie line from the project to the transmission system.

Transmission System Studies. MISO also analyzes whether the grid can handle the power from new energy projects, or whether the grid should be upgraded and, if so, how much those upgrades could cost and how they should be shared among interconnection applicants.18 Based on that allocation, each developer and respective transmission company negotiates and executes a generator interconnection agreement (GIA), which reflects the agreement between the developer and the transmission company for the construction of necessary interconnection facilities and transmission network upgrades. This GIA, which is subject to Federal Energy Regulatory Commission (FERC) review, plays a key role in a solar project’s success.

Land Acquisition and Diligence for Solar Projects

Solar projects require substantial amounts of largely flat, rural land. In addition, to minimize project risks, energy developers often seek a sufficient range of alternative sites to avoid sensitive areas such as wetlands and habitat for protected species and to prevent or minimize effects on any residential neighbors.

Land rights usually consist of 1) options with attached pre-negotiated lease or easement terms or 2) full leases with an early “feasibility” period that releases the developer if further study reveals that the project is not viable. During this early feasibility or option period, the developer is permitted to enter the property to conduct various due diligence studies while the landowner has existing use of the land (for example, for agriculture). The most important studies include soil borings and geotechnical analyses, a Phase 1 Environmental Site Assessment to identify any environmental conditions such as contamination, a cultural resources study to identify any historic landmarks or cultural sites, a wetlands delineation, and any habitat or species surveys in consultation with state and federal agencies.

In addition to technical studies, developers often obtain an ALTA standard coverage title insurance commitment and an ALTA survey that will uncover any exceptions to title, such as mortgages; mineral rights; utility easements; farm and timber leases; farm easements; rights of first refusal; and covenants, conditions, and restrictions. To address these exceptions, developers may 1) seek to carve out problem areas from exercise of the option (as with any site contamination); 2) obtain an ALTA 36 series of title insurance endorsements specific to energy projects; and 3) as necessary, obtain standard subordination and nondisturbance agreements, access agreements, or waivers from the third-party holders of these rights.

Typically, if these early diligence efforts indicate problems for the project, the developer can terminate the option or lease without liability. If issues are minimal and the option is exercised, most leases give the developer broad rights to construct the solar array on the property, build any access or temporary roads or lanes, lay underground or overhead wires and cables needed to facilitate connection of the array to the transmission system, and conduct any landscaping needed to prevent shading of the array, among other rights. However, as with any agreement, these lease terms are often negotiated, with an eye toward accommodating a landowner’s concerns while ensuring the developer has the flexibility needed to cost-effectively design and construct the project.

State and Local Permitting

While solar is a unique form of energy, large-scale developers still often need state and local permits to capture the sun. Specifically, solar projects larger than 100 megawatts must obtain a Certificate of Public Convenience and Necessity (CPCN), which requires the PSC to find that the project 1) will be in the public interest, 2) have no undue adverse impact on environmental values, 3) not interfere with orderly land use and development plans, and 4) have no adverse impact on competition in the relevant wholesale market.19 The PSC’s findings must be supported by substantial evidence in the record.20

The PSC recently issued CPCNs for four utility-scale solar projects comprising nearly 700 megawatts. With these CPCNs, the PSC imposed various conditions designed to mitigate the actual and perceived effects of those projects. For example, the PSC has required preconstruction noise studies to address potential noise from project construction, electrical and magnetic field surveys to address concerns from residential neighbors, and stray-voltage studies to address farmers’ concerns about potential effects on livestock. And, the PSC has required additional consultation with the Wisconsin Department of Natural Resources (DNR) regarding potential wetland and species effects.21

In addition to the CPCN requirement for projects of 100 or more megawatts, a regulated electric utility is required to obtain a certificate of authority (CA) when proposing to build or acquire a solar project that has a cost in excess of certain regulatory thresholds.22 Before granting a CA approval, the PSC must determine that the utility explored a range of alternatives to building the new energy facility and that the new project will not 1) substantially impair the efficiency of the service of the public utility, 2) provide facilities unreasonably in excess of the probable future energy requirements, or 3) add to the cost of service without proportionately increasing the value or available quantity of service.23

Finally, developers should be aware of any required local permits needed for the project. Wisconsin law limits local restrictions on solar developments, only allowing those restrictions that 1) preserve or protect the public health or safety, 2) do not significantly increase the cost of the system or significantly decrease its efficiency, or 3) allow for an alternative system of comparable cost and efficiency.24 These statutory restrictions generally prevent a local government from taking a one-size-fits-all approach to solar projects, instead requiring that any project-specific restrictions are warranted based on the specific circumstances at issue.25

Financing the Solar Project

Once the developer has secured interconnection rights, land rights, diligence studies, and permits, the project becomes attractive to institutional lenders interested in investing in the project. Most lenders of solar and other renewable energy projects use a project finance model for the most expensive aspects of the project, including solar equipment procurement (the solar panels) and project construction.26

To prepare for financing, the private energy developer bundles the “project assets” (the interconnection rights, land rights, state and local permits, construction contracts, equipment supply agreements, and other contracts) and transfers them to a project company, which is usually a wholly owned subsidiary of the developer, whose sole purpose is to develop, construct, and own the project. The project company then assigns those project assets to a lender as collateral for a substantial loan to complete the construction of the project. The lender’s primary recourse is the revenue from the sale of electricity from the project, plus a rate of return. Thus, lenders conduct extensive diligence into the viability of the project before issuing a loan to fund its construction.

In addition to institutional lenders, tax equity provides an additional form of financing for renewable energy projects. Under a typical tax equity “flip” structure, an energy developer partners with one or more large taxpaying corporate entities that have an appetite for tax incentives like the ITC. These large lenders or insurance companies typically invest a portion of the overall cost of the solar project and in return receive most of the tax incentives (that is, the ITC) generated from the project and a portion of the revenues. Once the tax equity investor’s rate of return achieves the target yield previously agreed on between the investor(s) and the project company, the percentage of the allocation of the partnership’s tax and cash attributes “flip” from the tax equity investor to the developer. At that time, the investor largely relinquishes its ownership stake in the project and the project company has the option to purchase the remaining stake.27

These financing models typically are used by private, wholesale power producers, rather than regulated public utilities. But that is starting to change. Regulated electric utilities in some jurisdictions are beginning to use the tax equity financing model, especially utilities with limited tax credit appetite seeking to monetize the tax incentives to reduce the cost of the project.28

Conclusion

Solar project development is a complex process, including interconnection, land rights, permitting, and financing. A clear understanding of how solar projects are developed and financed will help counsel for developers, landowners, local governments, and state agencies identify issues and understand the risks of participating in and permitting large scale solar projects. Due diligence, careful planning, and thoughtful coordination among the various stakeholders and their counsel will ensure an orderly process for solar development for Wisconsin that helps maximize the economic opportunity from this clean source of energy.

Cite to 93. Wis. Law. 42-47 (December 2020).

Meet Our Contributors

How do you recharge your batteries?

Prior to the pandemic, I recharged my batteries by attending concerts at one of the many fantastic live music venues in Madison (The Sylvee, High Noon, and the Majestic to name a few). Madison’s live music scene is exceptionally strong, and I have been fortunate enough to attend upwards of 20 concerts since moving to Madison in late 2018. The production of a concert, from the environment set by the lighting crew to the relationships among the musicians to the interactions with fellow concertgoers, is unique to each musician, and I thoroughly enjoy being part of the experience.

Prior to the pandemic, I recharged my batteries by attending concerts at one of the many fantastic live music venues in Madison (The Sylvee, High Noon, and the Majestic to name a few). Madison’s live music scene is exceptionally strong, and I have been fortunate enough to attend upwards of 20 concerts since moving to Madison in late 2018. The production of a concert, from the environment set by the lighting crew to the relationships among the musicians to the interactions with fellow concertgoers, is unique to each musician, and I thoroughly enjoy being part of the experience.

Because in-person concerts are no longer an option, I have dedicated more time to woodworking. In particular, I have been honing my skills making furniture completely with hand tools. Learning the intricacies and quirks of each hand tool requires my complete attention and has been a great opportunity for me to disconnect from the stressors of daily life. Right now, I am building a custom white-oak tool chest for my hand tools and carving cherry and maple spoons.

Mary N. Beall, Perkins Coie LLP, Madison.

How do you recharge your batteries?

There is nothing like a long run through the woods to clear my head after a day at the office (which, in these past months of COVID-19, is only a short commute from the kitchen). I love finding new trails – for hiking or trail running – in Madison and south-central Wisconsin, which are often hidden gems tucked away in both rural and urban parts of the state.

There is nothing like a long run through the woods to clear my head after a day at the office (which, in these past months of COVID-19, is only a short commute from the kitchen). I love finding new trails – for hiking or trail running – in Madison and south-central Wisconsin, which are often hidden gems tucked away in both rural and urban parts of the state.

Giving myself that space for mental quiet allows me to think through a problem or dispute that seemed intractable only a few hours before. It also allows me to step back and gain some perspective on some challenges in my work or just plan for what is coming my way tomorrow or the days ahead. And when I need something more than peace and quiet, I really enjoy running with friends and colleagues to catch up, trade ideas, and connect.

Speaking of people, and what I love most about my job? By far, I love the people I get to meet in the renewable energy sector and getting to learn about their businesses and see the commitment to their work. I really enjoy the teamwork and collaboration, by both clients and counterparties, that it takes to develop and construct a renewable energy project and place it in service.

It is exciting to see how quickly technology evolves in the energy sector throughout the United States. There is always something new to learn and always someone new to meet with knowledge and expertise in this rapidly changing industry.

Andrew C. Hanson, Perkins Coie LLP, Madison.

What legal memory will still bring a smile to your face 20 years from now?

Thanks to the diploma privilege, I started volunteering with the Dane County Eviction Defense Project almost immediately after graduating from law school. My first day, the project’s attorneys asked if I would represent a woman with a disability who was facing an unlawful retaliatory eviction. I was mortified by the possibility of letting the client down and by everything that I did not know about actually trying a case. Nonetheless, the project attorneys assured me that they would assist as co-counsel, and I submitted my notice of appearance.

Thanks to the diploma privilege, I started volunteering with the Dane County Eviction Defense Project almost immediately after graduating from law school. My first day, the project’s attorneys asked if I would represent a woman with a disability who was facing an unlawful retaliatory eviction. I was mortified by the possibility of letting the client down and by everything that I did not know about actually trying a case. Nonetheless, the project attorneys assured me that they would assist as co-counsel, and I submitted my notice of appearance.

Throughout discovery, motion practice, and settlement discussions the fear never really subsided, but it simultaneously served as motivation. I was constantly striving to stay one step ahead while learning both the procedure and the substantive law, and I was fortunate to have excellent guidance from the project attorneys along the way.

The morning of the trial, I received a call from opposing counsel agreeing to settle and dismiss the eviction proceeding. It was a very special moment having the opportunity to give my client the good news that she would be able to keep her home.

Jared E. Padway, Perkins Coie LLP, Madison.

What legal memory will still bring a smile to your face 20 years from now?

When I moved to the United States in 2012 and was introduced to the tax system, I was told that there are two things one cannot avoid in this country, death and taxes. However, as a volunteer at a tax clinic in Los Angeles, I saved a five-member household from losing their home to the IRS by negotiating an offer in compromise in accordance with section 7122 of the Internal Revenue Code. This experience was particularly meaningful to me because I had the opportunity to bust the myth, meet the family members, and after months of working in an area with which I was not particularly familiar, I proved the tax payer’s insolvency and reduced the initially assessed tax debt by approximately 90 percent.

When I moved to the United States in 2012 and was introduced to the tax system, I was told that there are two things one cannot avoid in this country, death and taxes. However, as a volunteer at a tax clinic in Los Angeles, I saved a five-member household from losing their home to the IRS by negotiating an offer in compromise in accordance with section 7122 of the Internal Revenue Code. This experience was particularly meaningful to me because I had the opportunity to bust the myth, meet the family members, and after months of working in an area with which I was not particularly familiar, I proved the tax payer’s insolvency and reduced the initially assessed tax debt by approximately 90 percent.

As to recharging my batteries? I connect with nature. I consider myself an outdoors person and bask in the wide array of options California offers. I enjoy backpacking in Yosemite National Park, Sequoia National Park, the east Sierras, and the San Bernardino Mountains. While backpacking can sometimes be a rough experience, it provides me with a closer connection to nature, which often results in a cathartic experience, new and improved ideas, and new friends.

I also enjoy road cycling along the Malibu coast and the Santa Monica Mountains. During the summer I connect with nature by open-sea swimming in La Jolla Cove near San Diego.

Jonathan Jimenez, Perkins Coie LLP, Los Angeles.

Become a contributor! Are you working on an interesting case? Have a practice tip to share? There are several ways to contribute to Wisconsin Lawyer. To discuss a topic idea, contact Managing Editor Karlé Lester at (800) 444-9404, ext. 6127, or email klester@wisbar.org. Check out our writing and submission guidelines.

Endnotes

1 The Beatles, “Here Comes the Sun” (EMI Studios 1969).

2 Chris Hubbuch, Tony Evers Proposes Carbon-free Electricity by 2050, Wis. St. J. (Mar 1, 2019).

3 Chris Hubbuch, Alliant Aims for Carbon-neutral Electricity, Says Plans Will Save Billions for Ratepayers, Wis. St. J., (July 22, 2020).

4 Pub. Serv. Comm’n of Wis. (PSC), Final Strategic Energy Assessment 2022, Docket 5-ES-108, Figure 7, at 18 (July, 2016) (PSC REF#:289792).

5 See Wisconsin Solar, Solar Energy Industries Ass’n (last visited Oct. 31, 2020) (noting that the 1 MW Jefferson Solar Project, installed in 2013, has capacity to power over 151 homes in Wisconsin); cf. Utility Scale Solar Farms in Wisconsin, Renew Wisconsin (last visited Oct. 31, 2020) (noting that “[a] one megawatt solar farm produces enough electricity annually to offset the needs of about 190 average Wisconsin homes”).

6 PSC, Final 2018-2024 Strategic Energy Assessment, Docket 5-ES-109, fig. 9 (Aug. 8, 2018) (PSC REF# 348358); PSC, Draft 2020-2026 Strategic Energy Assessment, Docket 5-ES-110 at 18 (June 3, 2020) (PSC REF#:390854).

7 MISO, MISO Generation Interconnection Queue.

8 PSC, Draft 2020-2026 Strategic Energy Assessment, Docket 5-ES-110, tbl. 1-6 (June 3, 2020) (PSC REF#:390854).

9 Growth in Solar is Led by Falling Prices, Solar Energy Indus. Ass’n (last visited July 28, 2020).

10 26 U.S.C. § 48.

11 IRS, Notice 2018-59, Beginning of Construction for the Investment Tax Credit under Section 48, at 10.

12 Id. at 3, 5.

13 Id.

14 Id.

15 MISO, About, www.misoenergy.org/about/ (last visited July 7, 2020). MISO is subject to oversight by the Federal Energy Regulatory Commission (FERC), which, under the Federal Power Act, 16 U.S.C. § 824a(a), regulates the interstate transmission of electricity.

16 MISO, Generation Interconnection Business Practices Manual, BPM-015-r22, sections 4.2.2, 4.4, & 5 (May 13, 2020).

17 Id. at 38

18 See generally id. at 35.

19 Wis. Stat. § 196.491(3)(d).

20 Wis. Stat. § 227.57(6).

21 See, e.g., PSC, Final Decision at 38-40, Docket No. 9800-CE-100 (Feb. 26, 2020) (PSC REF#: 384620).

22 See Wis. Stat. § 196.49 (5g)(ar) (identifying thresholds based on utility revenues).

23 Wis. Stat. § 196.49(3)(b); see also Wis. Stat. § 227.57(6) (requiring that PSC’s factual findings be based on substantial evidence in the record). In addition, in issuing a CPCN or CA, the PSC must also comply with the Wisconsin Environmental Policy Act (WEPA), Wis. Stat. § 1.11. However, the PSC has categorized new solar generating facilities as “Type III” actions that “normally do not have the potential to significantly affect the quality of the human environment, within the meaning of [WEPA].” Wis. Admin. Code § PSC 4.10(3), tbl. 3(cr). To facilitate review of CPCN and CA applications, the PSC and the DNR promulgated draft application filing requirements for solar energy projects (solar filing requirements). The solar filing requirements list the information required for a complete CPCN or CA application for a new solar project. Although not formally adopted by the PSC, the solar filing requirements provide important guidance on submitting and litigating CPCN and CA applications before the PSC.

24 Wis. Stat. § 66.401(1m); Numrich v. City of Mequon Bd. of Zoning Appeals, 2001 WI App 88, 242 Wis. 2d 677, 626 N.W.2d 366.

25 Ecker Brothers v. Calumet Cnty., 2009 WI App 112, 321 Wis. 2d 51, 772 N.W.2d 240.

26 E.R. Yescombe, Principals of Project Finance 5-8 (Academic Press, 2d ed. 2013).

27 For a more detailed description of the tax equity flip structure applied to solar projects, see Application of Wisconsin Power and Light Company for a Certificate of Authority for Acquisition, Construction, Installation, and Operation of Six Solar Electric Generation Facilities in Wisconsin, at 49-50, Docket No. 6680-CE-182 (May 28, 2020) (PSC REF# 390311).

28 Brian H. Potts & Andrew C. Hanson, Tax Equity Financing for Utilities: Another Helping of Renewable Energy, But Hold the Tax Credits, Forbes (July 18, 2018), https://tinyurl.com/yyxwnsjh; see, e.g., Ind. Util. Reg. Comm’n, Order In the Joint Petition of Northern Indiana Public Service Company LLC (NIPSCO) & Rosewater Wind Generation LLC, Cause No. 45194 (Aug. 7, 2019); Mo. Pub. Serv. Comm’n, Order In the Matter of the Application of the Empire District Electric Company, File no. EA-2019-0010 (June 29, 2019); Application of Wisconsin Power and Light Company for a Certificate of Authority for Acquisition, Construction, Installation, and Operation of Six Solar Electric Generation Facilities in Wisconsin, at 49-50, Docket No. 6680-CE-182 (May 28, 2020) (PSC REF# 390311).