Many lawyers have worked on a residential real estate transaction at one time or another. At first glance they may think the updated WB-11 Residential Offer to Purchase is a completely different contract. However, many of the offer provisions are substantially the same as before. What is most different is that the provisions have been rearranged to approximate the flow of the buying and selling of a residence.

The Real Estate Examining Board at the Department of Safety and Professional Services (DSPS) has approved an updated version of the WB-11 Residential Offer to Purchase. This form is the product of “drafting by committee,” specifically the DSPS Real Estate Contractual Forms Advisory Committee, comprised of real estate brokers and lawyers. For real estate licensees, the optional use date was Nov. 1, 2019, and the mandatory use date is Jan. 1, 2020.

The updated WB-11 Residential Offer to Purchase is available on the DSPS website, https://tinyurl.com/yfgte3zm.

Transactional Flow

The 2011 version of the WB-11 had several provisions out of any logical order, and users had to jump from page to page if a definition was needed. The inspection contingency was on the last page, but the inspection certainly is not the last step in the transaction.

Debra Peterson Conrad, U.W. 1979, is the senior attorney and director of legal affairs for the Wisconsin REALTORS® Association. She is coauthor of Wisconsin Real Estate Law (CLEW 2017), Wisconsin Real Estate Clauses (CLEW 2019), and Real Estate Trust Accounts in Wisconsin (CLEW 2014) and is on the Department of Safety and Professional Services’ Real Estate Contractual Forms Advisory Committee.

Debra Peterson Conrad, U.W. 1979, is the senior attorney and director of legal affairs for the Wisconsin REALTORS® Association. She is coauthor of Wisconsin Real Estate Law (CLEW 2017), Wisconsin Real Estate Clauses (CLEW 2019), and Real Estate Trust Accounts in Wisconsin (CLEW 2014) and is on the Department of Safety and Professional Services’ Real Estate Contractual Forms Advisory Committee.

In contrast, the first page of the updated WB-11 includes sections identifying what is “Included in Purchase Price” and “Not Included in Purchase Price,” immediately followed by the definition of “fixture” because that term plays a predominant role in those provisions. This cohesive sequence of provisions addresses what a buyer is to receive in exchange for the indicated purchase price without the user needing to scroll or flip pages to search for the fixture definition. Granted the closing is not the next step in the process, but the closing provision and a wire-transfer-fraud warning are included at the bottom of the first page because of their crucial importance.

Some of the familiar provisions have been modified.

Title Company Holding Earnest Money

In recognition of the practice in some areas of a title company instead of a real estate firm holding the earnest money, the language was modified with regard to who receives and holds the earnest money. A “strike-one” feature allows the parties to designate whether the earnest money will be delivered to and held by the listing firm, the buyer’s agent’s firm, or a third person named on a blank line. That might be a title company. An escrow agreement will be needed if a person other than a real estate firm holds the earnest money because the earnest-money-disbursement provisions in the offer apply only to real estate firms.

Meet Our Contributors

Why do you do what you do? What's the best advice you ever received? Share your weirdest courtroom story...

Lawyers have a lot to say. Our authors are no exception. Whether its personal, insightful, or fun, it’s always interesting.

Check out our Q&A with the author below

Delivery of Loan Commitments

The financing contingency has been renamed “Financing Commitment Contingency,” and the buyer’s loan commitment subsection has been replaced by a “Satisfaction of Financing Commitment Contingency” subsection, which, not surprisingly, tells the buyer how to satisfy the contingency. The buyer’s delivery of a loan commitment must be authorized; the buyer either signs the loan commitment or gives separate written directions for delivery that are delivered with the loan commitment, as was the case in the 2011 version of the WB-11. Delivery of a loan commitment by a lender or accompanied by a notice of unacceptability does not satisfy the contingency.

The caution following this provision warns the buyer: “The delivered loan commitment may contain conditions Buyer must yet satisfy to obligate the lender to provide the loan. Buyer understands delivery of a loan commitment removes the Financing Commitment Contingency from the Offer and shifts the risk to Buyer if the loan is not funded.”

Price Adjustments Based on Appraisal

The appraisal contingency on page 6 of the updated offer includes a right-to-cure option for the seller. If the buyer is dissatisfied with the appraised value, the buyer can deliver a copy of the appraisal report along with a notice objecting to the appraised value. If the seller has the right to cure, the seller may deliver written notice to the buyer adjusting the purchase price to match the appraised value. The form also provides that the parties agree to promptly execute an amendment to the offer, if initiated by either party, to change the purchase price. This may be required by the lender.

If the seller does not have a right to cure or does not deliver notice adjusting the purchase price, the offer will be null and void. The parties can instead agree to an amendment naming a compromise price or some other solution, as would also be the case in other offer contingencies.

Buyer’s Property Not Sold Before Closing

The “Closing of Buyer’s Property” contingency on page 6 of the revised WB-11 indicates the consequences if the transaction for the sale of the buyer’s property does not close by the stated deadline. Specifically, the offer becomes null and void if the deadline passes without a closing unless the buyer delivers to the seller, on or before the deadline, reasonable written verification that the buyer has the funds to close from a financial institution or third party in control of the buyer’s funds.

Laundry List for Avoiding the Bump

The bump clause is now a separate checkbox item. The most important change in the bump clause, which appears immediately after the closing of buyer’s property contingency, is the default of 72 hours for the bump clause time frame if nothing is entered on the blank line, a mistake sometimes made by real estate agents.

A buyer receiving a bump notice from the seller must deliver the listed items to avoid termination of the offer. First, a written waiver of the closing of buyer’s property contingency must be delivered to the seller if that contingency is a part of the offer. Second, a waiver of any additional contingencies written in the blank line must also be delivered. Third, the buyer must deliver any other documentation indicated, for example, a bridge loan, third-party reasonable written verification of funds, and other requirements written into the provision.

Homeowner Association Transfer Fee

The new homeowner-association provision advises the parties that if the property is subject to a homeowner association, there may be periodic fees and a fee upon the transfer of the property. The parties indicate whether any transfer fee will be paid by the buyer or by the seller.

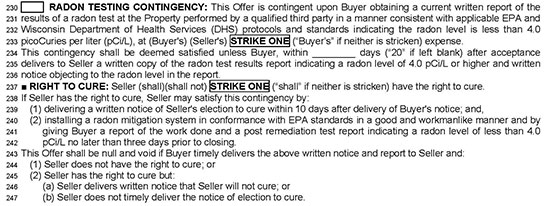

Radon Mitigation

Because many offers are drafted incorrectly with radon testing written into the inspection contingency, and some home inspectors conduct radon testing without seller permission, an optional radon-testing contingency was added to the offer. (See Figure 1: Radon Testing Contingency.)

The buyer may arrange for radon testing performed by a qualified third party consistent with U.S. Environmental Protection Agency (EPA) and Wisconsin Department of Health Services protocols and standards. The contingency is deemed satisfied unless the buyer delivers a copy of test results showing a radon level of 4.0 picoCuries per liter (pCi/L) or higher and a notice objecting to the results.

The parties choose whether the seller has a right to cure. If the seller elects to cure, the seller must install a radon mitigation system in conformance with EPA standards in a “good and workmanlike” manner and give the buyer a report of the work done and a post-remediation test report indicating a radon level of less than 4.0 pCi/L no later than three days before closing.

Figure 1: Radon Testing Contingency

When Sellers Are Foreign Persons

Buyers purchasing a property from a person classified as a “foreign person” are subject to the Foreign Investment in Real Property Tax Act (FIRPTA), a law passed in response to concerns that foreign sellers might leave the United States without paying the tax due on the sale. The IRS solution is to make the buyer responsible for ensuring the tax is collected.

Although these transactions may be infrequent, buyers who do not comply with FIRPTA can be held responsible for a foreign seller’s unpaid tax. The blame – and the penalty – for noncompliant buyers has at times been shifted to real estate agents, primarily because they did not alert buyers to FIRPTA. Accordingly, Wisconsin is following the example set by other states, such as Minnesota, by adding a FIRPTA provision to the offer.

The provision in the offer presumes the seller is not a foreign person and indicates the seller must execute and deliver to the buyer, or a qualified substitute, a sworn certification under penalties of perjury stating the seller’s nonforeign status. This action leads the seller down the path toward meeting the terms of a FIRPTA exception, thus eliminating any need for the buyer to withhold seller proceeds. The seller’s certification is the buyer’s golden ticket, an insurance policy that the buyer will not be liable to the IRS for a foreign seller’s unpaid tax.

Because many offers are drafted incorrectly with radon testing written into the inspection contingency, and some home inspectors conduct radon testing without seller permission, an optional radon-testing contingency was added to the offer.

The offer states that if the seller does not deliver the certification at least 15 days before closing, the buyer will be entitled to 1) withhold up to 15 percent of the total amount realized in the sale or 2) terminate the offer by written notice to the seller at any time before closing. The 15-day time frame was included to allow time for the parties, their advisers, and the title company to implement FIRPTA withholding, satisfy the requirements of another FIRPTA exception, or otherwise negotiate a resolution before the closing date.

The offer indicates the seller certification is to be delivered to the buyer or a qualified substitute, which includes the lawyer or the title company responsible for closing the transaction. Delivery to the title company is the preferred resolution from a real estate licensee’s perspective because the certification includes the seller’s tax identification number: the certification goes from the seller to the title company without licensees having to transmit or store it. The qualified substitute must deliver a statement to the buyer advising that the substitute has the seller’s certification. Thus, the buyer does not receive the seller’s tax identification number, and the seller does not receive the buyer’s direct contact information.

The offer provision states, “The Parties are advised to consult with their respective independent legal counsel and tax advisors regarding FIRPTA.” Legal advice will be needed regarding whether particular sellers are foreign persons, qualifications for other FIRPTA exceptions, and assistance with any withholding.

Conclusion

As with any form update, the revisions to the 2020 WB-11 Residential Offer to Purchase may enhance clarity and ease of use and lead to new concerns to be rectified in the next round of revisions.

Meet Our Contributors

Who does the holiday baking, decorating, and meal making at your house?

Baking for the holidays with all of the breads, pies, cookies, and Scandinavian pastries is one of my passions! What could be better than sharing delicious morsels representing family and cultural traditions with family, friends, and coworkers? Ditto for the holiday decorations and the magical lights both inside and outside the house; nothing is more joyful than the sparkle of twinkling lights and those special tree ornaments and decorations handed down through the generations or handmade by family members.

Baking for the holidays with all of the breads, pies, cookies, and Scandinavian pastries is one of my passions! What could be better than sharing delicious morsels representing family and cultural traditions with family, friends, and coworkers? Ditto for the holiday decorations and the magical lights both inside and outside the house; nothing is more joyful than the sparkle of twinkling lights and those special tree ornaments and decorations handed down through the generations or handmade by family members.

When it comes to preparing those mouthwatering special meals, that is the time to enlist the special talents of my sister and other family members who are masters of culinary delights, honoring the special recipes and dishes prepared by generations past.

The holidays are celebrations of joy, family, and tradition at my house.

Debra Peterson Conrad, Wisconsin REALTORS® Association, Madison.

Become a contributor! Are you working on an interesting case? Have a practice tip to share? There are several ways to contribute to Wisconsin Lawyer. To discuss a topic idea, contact Managing Editor Karlé Lester at (800) 444-9404, ext. 6127, or email klester@wisbar.org. Check out our writing and submission guidelines.