The legal industry has had to adapt to an increasingly digitized world, with software solutions for timekeeping, document organization, and practice management changing how lawyers conduct their daily practice.

How people pay for things is changing, too. Just 30 years ago, it wasn’t uncommon to see “cash only” signs in storefront windows. Today, payment methods such as ApplePay, Android Pay, and Google Wallet have proliferated. Peer-to-peer payment apps like Venmo are gaining popularity, and Bitcoin and other cryptocurrencies are roiling markets and disrupting the financial sector. Still reigning supreme are the major credit card brands: Visa, MasterCard, and American Express.

Many experts believe we’re on our way to a cashless, checkless society. With so many digital payment options and the convenience they bring, it’s no surprise online payments have become the norm and most people’s preferred payment method.

Electronic Payments Continue to Dominate

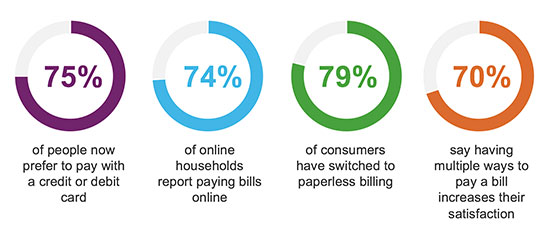

According to a recent survey by TSYS, a payment processing company, 75 percent of people now prefer to pay with a credit or debit card. Research from Fiserv found that 74 percent of households that have internet access report having paid bills online, 79 percent of consumers have switched to paperless billing, and 70 percent say having multiple ways to pay a bill increases their satisfaction with the biller. (See “How Consumers Prefer to Pay Bills.”)

Amy Mann is the communications director at LawPay and lives in Austin, Texas. She is a senior communications specialist and educator with more than a decade of experience working in the legal, accounting, and financial services industries.

Amy Mann is the communications director at LawPay and lives in Austin, Texas. She is a senior communications specialist and educator with more than a decade of experience working in the legal, accounting, and financial services industries.

What it comes down to is people want more online payment options, and the businesses that deliver these make customers happy.

Research also shows more people are giving up checks altogether. According to one survey, more than one-half – 55 percent – of consumers don’t use or rarely carry checkbooks. Most people never write a personal check or only do so a few times per year, and among the youngest cohorts, the data is even more stark: 61 percent of 18- to 24-year-olds never write checks. Another survey found 52 percent of millennials – who will turn 22-38 years old in 2019 – never use checks. And the number of bills paid by check fell 20 percent from 2010 to 2016.

Expectations of businesses are shifting, too. Like it or not, all businesses are now being held to the higher customer experience standard that companies like Amazon are setting. TSYS found 65 percent of people expect to pay with a credit or debit card from a biller’s app or mobile website, and 79 percent expect local service providers (for example, lawyers) to offer the same payment options as large national companies.

The bottom line? Your professional reputation is at stake. Clients expect lawyers to use the latest tools, processes, and technology available to handle their legal issues adeptly and efficiently. Furthermore, if a lawyer only offers traditional payment options like cash and check, clients might wonder whether the lawyer has kept up with the latest legal developments and processes. These days, running an old-fashioned office doesn’t instill confidence.

You want to be seen as modern, technologically competent, and easy to work with. Modern online payment tools are one key aspect of that, allowing you to show clients and prospects that you embrace the innovations of the Digital Revolution.

How Consumers Prefer to Pay Bills

What Makes a Modern Client Experience

In today’s tech-focused world of instant gratification, where we all have a computer in our pocket or purse, people have become accustomed to – and spoiled by – frictionless customer experiences. So what exactly does that mean?

The term “frictionless” here refers to fewer steps, simpler interactions, and fewer barriers to completion for customers or clients. For example, Amazon eliminated the need to go to a store, reduced the research burden on consumers by using data to present them with products they’d like, and pioneered the “one-click ordering” process to nudge customers toward faster, more seamless checkouts.

Netflix eliminated the need to go to the video rental store, provided instant gratification and 24-hour service, and completely streamlined and digitized the movie-ordering and payments process. Uber eliminated the traditional first step of ordering a ride – the phone call – along with the transactional physical-payment step where cash or card changes hands, resulting in optimizations for speed, efficiency, and service.

Getting Paid Faster

Optimizing Customer Service for Law Clients

How does this apply to lawyers? Professional services firms can also look at all of their client interactions and identify ways to remove friction at each step. One way to remove friction from billing and payment processes is with a modern online payment solution. Doing so will allow you to simplify billing and payment interactions and remove barriers to completion, so that clients pay your bills faster and more reliably. Here are some of the ways online payment tools reduce friction in your client experience.

-

Eliminate Paper Bills. If you’re still asking clients to wait for a paper invoice in the mail and then send in a paper check, you have a big opportunity to streamline those processes for the modern age. A digital solution is faster and simpler and even creates a cleaner, more manageable “paper trail” for clients, because it’s all online. Clients can search their email for past bills, rather than pawing through paper files. (See “Getting Paid Faster.”)

-

Stop Requiring Payment by Check. People have grown so accustomed to paying with plastic or clicking a button that they expect to be able to, which is why so many no longer carry cash or checks. For prospective clients who don’t use checks, a demand for payment by check may drive them to another lawyer. (See sidebar, “Credit Card Processing: How to Get Started.”)

Christie Feyen, assistant director at the Zinda Law Group, loves the convenience an online payment solution provides to her clients. “We run our bills biweekly and so it’s the most convenient way for our clients to pay their bills on time. It’s quick, it’s easy, and there’s no hassle.”

-

Provide Instant Payment Confirmation. Immediate gratification has become a hallmark of the modern online buying experience, and an online payment solution lets you provide this perk to your clients. A great online payment platform will let you set up automatic payment receipts that are emailed to clients after they pay their bill, in the same way they’re used to getting a near-instantaneous order confirmation from other businesses.

-

Offer a 24-hour Virtual Service. Most people are accustomed to shopping online or paying bills on the weekend or in the evening. An online solution also lets lawyers effortlessly expand their hours of service. When clients can go to your website and pay online on their own schedule, they see that as another small, but cumulative way in which you’re making an effort to meet their needs.

Lawyers who want to remain competitive in the fast-changing service industry landscape recognize the value in setting themselves apart with a stellar client experience. The vast majority of people say having multiple ways to pay their bill increases their satisfaction, so you have nothing to lose and a lot of client satisfaction to gain by reducing friction in your billing and payments processes.

Conclusion

It’s only a matter of time before online billing and payments processes come to dominate every industry – even the legal industry. This means adopting online payments is no longer a question of if, but when, as more prospective clients will choose lawyers who do offer these options.

The good news is you have much more to gain from this technology shift than you stand to lose. Greater operational efficiency and significant time savings more than offset the cost of an online payment solution.

Finally, providing exceptional service is one of the best ways for professional service firms to delight clients, increase repeat business, and win more referrals. In today’s world of instant gratification and lightning-fast technology, letting clients pay with just a click is an easy win.

Credit Card Processing: How to Get Started

Your State Bar membership entitles you to 25 percent off credit card processing fees through LawPay.

LawPay, an affinity partner, is one vendor of payment processing plans. A LawPay merchant account, by processing credit card payments quickly and easily, streamlines accounting and reduces the time spent monitoring and managing trust and operating accounts. In addition, LawPay offers “Click to Pay,” a secure online payment link you can send by email, place on your website, or include on your invoices, that allows clients to pay their bills online. The payment link takes the client to a payment page.

Payments flow separately into general and trust accounts according to the law firm's direction, and LawPay fees are debited from the general account only.

To learn more about credit card processing and electronic billing or get your customized billing page, call LawPay at (866) 376-0950 or visit lawpay.com/member-programs/wisconsin-state-bar.

Your State Bar membership entitles you to discounts on some payment processing plans. State Bar members save up to 25 percent off their credit card processing fees.

<iframe src="//www.youtube.com/embed/7PoaphJj0Rs" width="525" height="295" frameborder="0" allowfullscreen></iframe>