On Dec. 22, 2017, the Tax Cut and Jobs Act (Act) was signed into law.

Two major changes made by the Act impact charitable contributions for tax years between Dec. 31, 2017, and Jan. 1, 2026 (the effective period for the Act):

-

The standard deduction was increased to $24,000 for married couples (filing jointly) and to $12,000 for individuals.

-

Itemized deductions for state and local taxes (SALT) are limited to $10,000 per year.

This means that, to benefit from itemizing deductions, married couples will need to have $14,000 of non-SALT itemized deductions including charitable contributions. Individual taxpayers have a lower bar to hurdle of only $2,000 of non-SALT itemized deductions.

These changes will not impact most taxpayers who make charitable contributions for reasons other than tax benefits or who may or may not have been itemizing deductions; nor will it impact most high-income taxpayers who already make annual charitable contributions over $14,000.

But for those who want to make tax efficient charitable contributions, the following may be useful techniques.

Bunching Contributions

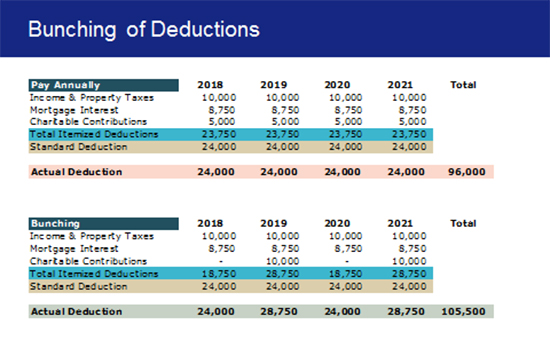

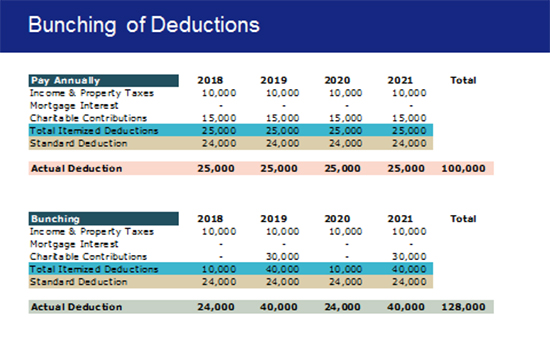

To benefit from itemizing in light of the SALT limitation of $10,000 for married filing jointly, consider bunching charitable contributions in one year, then use standard deduction in other years.

Exhibit A below shows the increased power of bunching two years of charitable contributions in one year, while still meeting the donors’ charitable intent of having the same amount of money go to their favorite charities over the four year period.

Exhibit A: The effect of bunching two years of charitable contributions into one year. Images used with permission of Tim Steffen, CPA/PFS, CFP®, CPWA®, Director of Advanced Planning, Baird Private Wealth Management.

For taxpayers who bunch charitable contributions, establishing a donor advised fund (DAF) at a local community foundation is an alternative to making the contributions directly to the charities.

Charitable contributions in the year of bunching could then be made into the DAF in one year, but then distributions can be made from the DAF in years where the taxpayer does not itemize in order to keep the taxpayers’ charitable contributions to various charities level throughout the years.

Finally, if taxpayers are bunching charitable contributions in one year, make sure they let the charities know that they are bunching, for instance, two years of annual fund giving in one year, so the charity knows not to hit the donor up for an annual fund gift in year two.

Attorneys who advise charities and/or sit on charitable boards should alert the development departments to be mindful of bunching for good donor relations.

Qualified Charitable Distributions

If a taxpayer is over age 70½, they must take required distributions from qualified plans, like an individual retirement account (IRA). Those distributions are included in the taxpayer’s adjusted gross income (AGI), and other items on tax returns are impacted by the level of a taxpayer’s AGI. They could then turn around and make a charitable contribution with those funds, but under the new environment, those contributions may not be fully deductible.

Instead, a taxpayer could make a qualified charitable distribution directly from an IRA to a public charity. The taxpayer does not receive a charitable contribution, so it doesn’t matter if they are able to itemize deductions, but the distribution is also excluded from the taxpayer’s AGI. Taxpayers must be over age 70½, the distribution can only come from an IRA (not a 401(k)), it is limited to $100,000 per year, and the distribution must be made to a public charity, which cannot include a donor advised fund of which the taxpayer is the donor advisor or the donor’s private foundation.

Gifts of Appreciated Property

If capital gain property is appreciated, its sale will result in capital gain recognition. If that property is contributed to a public charity, the tax on the appreciation most likely could be avoided and the charitable contribution would be at fair market value.

So, even if a taxpayer is not itemizing deductions in one year, the income tax avoidance of the tax on appreciated securities could be a significant savings.