As a member of the Taxation Law Section, my thanks to the Labor & Employment Law Section Board for inviting me to submit this guest post. My thanks, also, to those who came to see my presentation on this topic at the Labor & Employment Law Section CLE Luncheon – either live in Milwaukee or Madison, or on the webcast.

For an introduction to this topic, see the outline from that presentation, available on WisBar.org.

In this post, I’d like to supplement those materials with a series of hypothetical examples in order to illustrate a few concepts in “real dollar” terms.

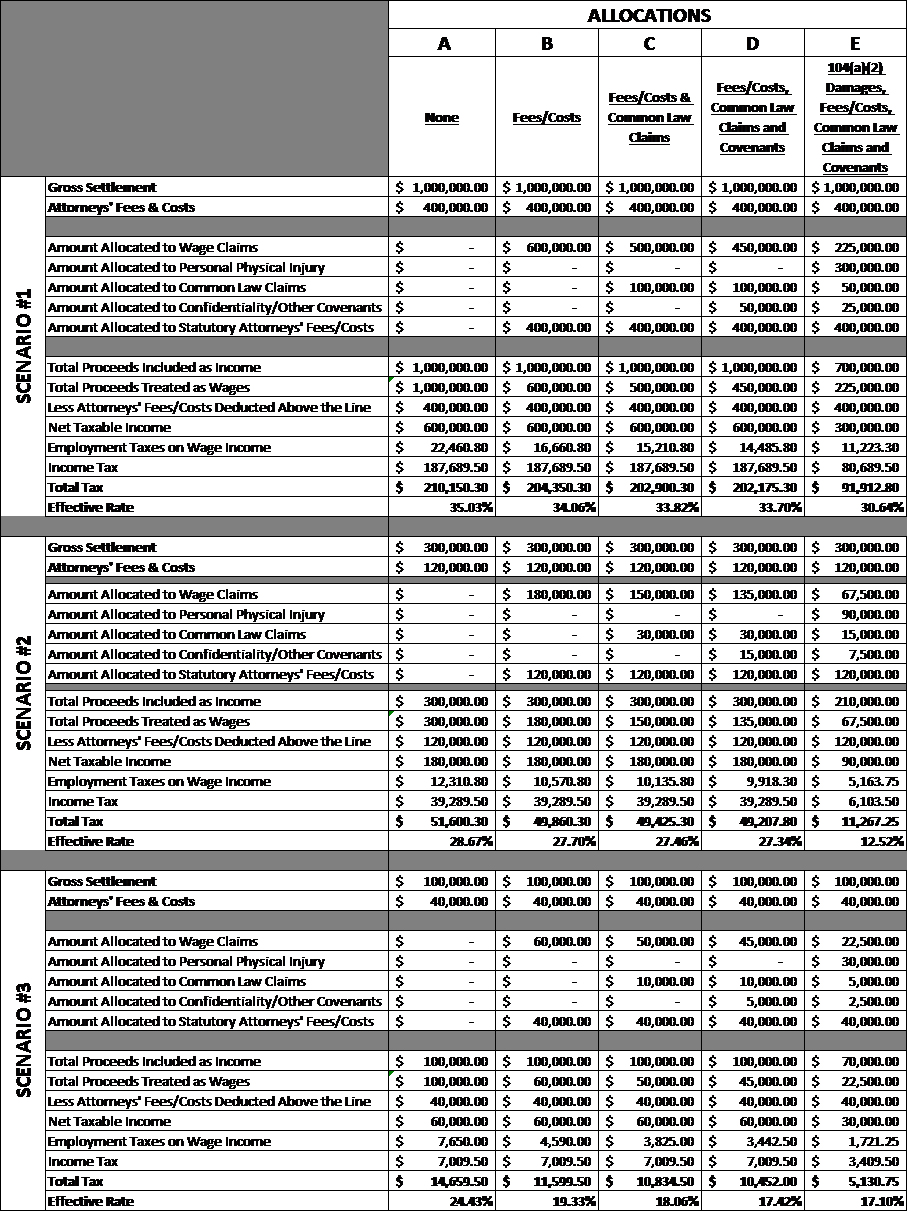

In the chart below, we have three separate settlement scenarios:

- Scenario #1 is a gross settlement of $1,000,000

- Scenario #2 is a gross settlement of $300,000

- Scenario #3 is a gross settlement of $100,000

In each of these scenarios, the total attorneys’ fees and costs for which the plaintiff is responsible is equal to 40 percent of the gross settlement proceeds.

Within each of these three settlement scenarios, we also have five alternative allocation models, labelled A through E and detailed below:

Model A

In this model, the settlement agreement provides for no express allocation of the gross settlement proceeds – not even to the attorney’s fees and costs payable by the plaintiff.

Model B

In this model, an allocation is expressly made only to amounts otherwise payable as attorney’s fees/costs (40 percent) – with the balance (60 percent) unallocated and subject to treatment as wages.

Model C

In this model, an allocation is expressly made to amounts otherwise payable as attorney’s fees/costs (40 percent) and to amounts paid in settlement of non-wage/non-physical injury common law claims (10 percent) – with the balance (50 percent) unallocated and subject to treatment as wages.

Model D

In this model, an allocation is expressly made to amounts otherwise payable as attorney’s fees/costs (40 percent), to amounts paid in settlement of non-wage/non-physical injury common law claims (10 percent), and to amounts payable in respect of one or more contractual covenants (e.g., non-disclosure, non-disparagement, etc.) (5 percent) – with the balance (45 percent) unallocated and subject to treatment as wages.

Model E

In this model, an allocation is expressly made to amounts otherwise payable as attorney’s fees/costs (40 percent), to amounts paid in settlement of common law claims (5 percent), to amounts payable in respect of one or more contractual covenants (2.5 percent), and to amounts payable in respect of personal physical injury claims (30 percent) – with the balance (22.5 percent) unallocated and subject to treatment as wages.

Click on the chart to see a larger version on WisBar.org.

A review of the varying federal income and employment tax consequences (which are computed on the further assumption that the plaintiff is filing as a single individual with no exemptions) reveals the significance of a number of the dynamics described in the outline.

The most notable consequence of Model A (in any of the Scenarios) is that, per the guidance set forth in Rev. Rul. 80-364, 1980-2 C.B. 294, as extended by Chief Counsel Memorandum 20133501F (Aug. 30, 2013), the entire amount of the gross proceeds – even those amounts payable by the plaintiff as attorney’s fees/costs – would be regarded as “wages” and, as such, subject to employment taxes.

Assuming that attorney’s fees/costs would have been recoverable under any of the statutory claims being settled (which is typically the case in employment law claims), the plaintiff should at least insist on including an express allocation for such fees/costs in the settlement agreement. This should not be a controversial point in negotiations and the cost of failing to do so can be clearly seen by comparing the “Employment Taxes on Wage Income” line as between Model A and Model B in each of the three scenarios. This is a real and easily avoided expense.

Models C and D present examples in which the parties are taking dollars otherwise allocable to wage claims and allocating them to “non-wage” items, such as common law claims and/or contractual covenants. What is notable in comparing these Models C and D across the three scenarios is that such allocations are more impactful (proportionally) in the lower dollar settlement scenarios. This is because the Old-Age, Survivors, and Disability Insurance (OASDI) portion of the employee’s Federal Insurance Contributions Act (FICA) amount (which is 6.2 percent) caps out at $128,400 for the year 2018, while only the Hospital Insurance (Medicare) portion of the employee’s FICA amount (which is 1.45 percent) applies to all wages without any cap. Thus, in Scenario 1 (where the wage claim is well above the OASDI limit in all 5 models), the benefit of moving dollars into a taxable “non-wage” category is only 1.45 percent. By contrast, in Scenario #3 (where the wage claim is well below the OASDI limit in all 5 models), the benefit of moving dollars into a taxable “non-wage” category is a full 7.65 percent.

Note: While there may be legitimate grounds to allocate settlement dollars to these “non-wage” items – indeed, some allocation to these items may be necessary (see, e.g., Eugene Amos, Jr. v. Commn’r, T.C. Memo. 2003-329 (2003)) – the appropriate amount to be so allocated is not as clear-cut as attorney’s fees/costs, and the plaintiff and defendant lack any “tax adversity” of the sort that would ordinarily ensure its accuracy (viz. both sides would just as soon have a lower wage amount because they both contribute to the employment taxes thereon). However, if the IRS were to challenge the allocation, re-characterize these amounts as “wages” and seek back employment taxes and interest, the Service would simply go after the defendant employer – who bears primary responsibility for any deficiency. Absent an indemnity from the plaintiff, the defendant employer may not have a meaningful recourse to recoup this amount from the plaintiff.

Finally, the most notable aspect of Model E – and hardly a surprising one – is that the exclusion from income under I.R.C. Section 104(a)(2) is pretty potent where available. The claims made at the outset of action – whether in demand letter or formal complaint – will largely frame the available bases for the allocation of any resulting settlement. Accordingly, to the extent that there is any credible basis to claim a personal, physical injury, this should be put front and center in the demand or complaint and, if possible, should be incorporated as factual predicate of each claim.