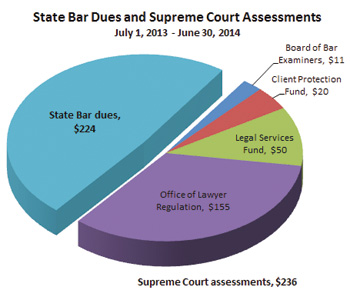

May 9, 2013 – For the fiscal year starting July 1, 2013, State Bar of Wisconsin dues remain at $224 for full dues-paying active members for the 10th consecutive year. The four Wisconsin Supreme Court-imposed assessments also remain the same as last year. The 2013-14 State Bar of Wisconsin dues and Wisconsin Supreme Court assessment statements were mailed earlier this week.

State Bar Uses Reserves to Maintain 2004 Dues Levels

Next month, the Board of Governors will vote on a budget that proposes to use reserve funds to supplement fiscal year 2014 (July 1, 2013, to June 30, 2014) to meet a projected $444,634 shortfall. The proposal taps two reserve funds to balance the budget.

If the board approves the proposed budget, the State Bar will deplete the Dues Stabilization Reserve Fund, which was established to mitigate dues increases. The Opportunities Reserve Fund, which was created to provide funds to take advantage of emergent opportunities in products and services, will be tapped for $58K. The $11.7 million budget includes a 2 percent increase over the approved operating budget for 2013.

At its April meeting, the 52-member board was divided on whether to spend down the remaining Dues Stabilization Reserve Fund. Those supporting the depletion of the reserve fund state that the fund is there for the purpose of stabilizing dues levels, and that dues should not be raised without exhausting this reserve.

Other governors questioned the wisdom of depleting the reserve funds, noting that dues have not increased for a decade, while costs of doing business continue to increase. Some governors stated that dues are rather minimal when considering the benefits and services the State Bar offers, in comparison to other membership organizations.

The proposed budget also includes a program management audit to review operational efficiency throughout the organization and help determine the proper amount of dues down the road. The board was split on this issue as well. Some thought that dipping into reserves to help fund a study on where to spend money was fruitless. Others believe the study made good business sense and would help guide the Board in future decision making.

The proposed budget also includes a program management audit to review operational efficiency throughout the organization and help determine the proper amount of dues down the road. The board was split on this issue as well. Some thought that dipping into reserves to help fund a study on where to spend money was fruitless. Others believe the study made good business sense and would help guide the Board in future decision making.

State Bar dues and assessments vary based on membership classification. Payment is due to the State Bar by July 1, 2013. If you do not receive your statement by mid-May, contact Customer Service at (800) 728-7788. Or, visit myStateBar at WisBar.org to verify the State Bar has your current address on file. If you have not yet paid your dues, you will find a link to download a dues form. You can also visit myStateBar to verify that the State Bar has processed your payment. Your receipt and membership card should arrive within two weeks from the date the Bar receives payment.

Supreme Court Assessments Remain at Current Level

The supreme court-ordered fees include assessments supporting the Board of Bar Examiners (BBE), Office of Lawyer Regulation (OLR), Public Interest Legal Services Fund, and Wisconsin Lawyers' Fund for Client Protection. See chart for the fees for full active licenses for lawyers in practice three or more years include:

The court also assesses active-licensed attorneys and judicial members $50 for the Public Interest Legal Services Fund, paid to the Wisconsin Trust Account Foundation, to fund civil legal services for people who cannot afford an attorney.