In the past, energy law was a practice area confined to a few attorneys who represented regulated public utilities in Wisconsin. There was not much need for attorneys in general practices to have any knowledge about this topic because energy costs were relatively low. Today, this is no longer the case. General-practice attorneys should have more than a passing knowledge of legal strategies to reduce energy bills because this goal is a high priority with commercial and industrial clients.

In the past, energy law was a practice area confined to a few attorneys who represented regulated public utilities in Wisconsin. There was not much need for attorneys in general practices to have any knowledge about this topic because energy costs were relatively low. Today, this is no longer the case. General-practice attorneys should have more than a passing knowledge of legal strategies to reduce energy bills because this goal is a high priority with commercial and industrial clients.

Investor-owned utilities have made massive investments in baseload generation as well as transmission facilities to ensure electrical reliability in Wisconsin. This massive investment has been added to the rate base and has the necessary effect of significantly increasing energy bills. All available information suggests that average energy costs will continue to increase in the foreseeable future.1 This upward trend in projected costs is reinforced by the U.S. Environmental Protection Agency’s (EPA’s) recent announcement of the Clean Power Plan for electrical utilities. This plan will likely require substantial additional investments by Wisconsin utilities to comply with the new electrical generation regulations.2

The regulated electrical utility system in Wisconsin affords customers very few options for selecting a provider. However, energy efficiency is an available strategy option for commercial building owners to reduce utility costs today and provide a hedge against ever-increasing costs in the future.

Wisconsin lawyers should learn about the options that are available to meet their clients’ increasing concerns and interests in this area. While efficiency projects might make buildings more valuable for current and future owners, many energy-efficiency-upgrade proposals encounter challenges in traditional lending markets asked to finance such projects. The required payback periods for such major efficiency-upgrade projects are frequently too long for such projects to “cost out” under traditional lending practices.3

“Property Assessed Clean Energy” (PACE) programs have emerged as an innovative new statutory financing mechanism for efficiency-upgrade projects. PACE programs can cover 100 percent of the improvement costs and are financed for up to 20 years through an existing municipal-tax special-charge system for property owners. In particular, the PACE model for financing is similar to public financing for public infrastructure such as roads, sidewalks, and public improvement projects connected directly to existing buildings. More than 30 states have adopted statutory implementing structures that authorize municipalities to adopt PACE financing ordinances for energy and water improvement projects.4 As of May 2014, nearly 500 municipalities in the United States were participating in PACE programs.5

The Wisconsin Legislature recently enacted a law that authorizes municipalities to enact PACE ordinances, expanding the municipal tax assessment authority to cover lenders who make loans for upgrades to existing buildings for energy efficiency, renewable energy, and water efficiency projects.6 Currently, Milwaukee is the only municipality in the state to adopt a PACE financing ordinance under Wisconsin’s new implementing law.7 But this financing structure provides an opportunity for Wisconsin attorneys to assist, and provide solutions for, a variety of clients.

This article provides an overview of the PACE financing structure with an emphasis on the Wisconsin enabling statute and Milwaukee’s ordinance. It demonstrates the importance of this new innovative financing structure for attorneys who practice in a wide range of practice areas, including real estate, lending and finance, and municipal law. Finally, the article explains how attorneys can provide new financial stability for clients while playing a vital role in the success of this new financing solution.

How Commercial PACE Financing Works

PACE financing is very attractive to commercial property owners who seek to save money and make their buildings more valuable for future buyers as well as current and future tenants. Knowledgeable existing mortgage lenders who understand the benefits of the program frequently will support projects that increase the value of their underlying collateral.8 Municipalities have proven to be very much in favor of PACE financing because it not only supports construction jobs for these authorized building upgrades but also preserves and enhances the existing commercial building stock in the community. Additionally, PACE financing requires no direct subsidies from municipalities.

PACE financing creates a strong incentive for commercial property owners to undertake energy efficiency upgrades in their buildings. Under a PACE financing program, property owners develop a qualified energy efficiency project. The projects will vary depending on the municipality, but generally include things such as new boilers, chillers, building controls, lighting, and solar energy. Depending on the program structure, property owners can arrange project financing with a financial institution of their choice or take advantage of financing from the participating municipality, if it is available.

Private investors in PACE projects are interested in the PACE program because the superior PACE liens are a proven method to provide secured collateral for these projects. PACE financing provides a 100 percent financing option and generally requires no upfront cash investment for projects.9 Since PACE financing depends on the special-charge process (putting financing payments on property tax bills), long-term financing is available for up to 20 years on these qualified building efficiency projects. The reduction in utility costs results in immediate cash-flow benefits for the building owner and its tenants. The differences between traditional project financing and PACE financing provide key solutions to make large, more significant energy-retrofit projects finally viable for building owners (see Figure 1).

PACE financing also has the added benefit of no due-on-sale clause. When a building containing the PACE financed project is sold, the future payoff obligation runs with the land to the new owner. The current building owner pays for the improvements only during ownership, and subsequent owners pay the annual special charge while they continue to benefit from the energy savings. In addition, the special-charge costs and savings can be shared with tenants under traditional commercial-lease provisions.

Typically in a building where tenants pay the energy bills, property owners might not see a strong business case for investing in energy-efficiency upgrades. However, PACE makes a stronger case for energy-efficiency-upgrade projects, by passing along the costs and savings to the tenant. Finally, an approved PACE project has the potential to be treated as an off-balance-sheet financing mechanism for the building owner for such projects. The nonrecourse, off-balance-sheet, and nonaccelerating financing features are very attractive to interested parties.10

Figure 1

Comparison of Traditional and PACE Project Financing

| Traditional Capital Project Financing |

PACE Project Financing |

| Financed by loan, budget |

Financed through special tax assessment |

| Term: 3-7 years |

Term: Up to 20 years |

| Payback required: 3-6 years |

Payback required: Life of equipment |

| Cash flow negative |

Cash flow positive |

| Upgrades may take more than 5 years to complete |

Upgrade whole building at once |

| Capital expense |

Operating expense |

| |

No down payment |

| |

Option to pass cost through to tenants |

PACE in Wisconsin

Wisconsin has adopted a law providing legal authority for municipalities to impose a special use charge against properties for qualified energy-efficiency, renewable-energy, and water-efficiency projects for existing commercial buildings.11 Under the statute, the municipality is authorized to enter into agreements using the special-charge process as a method of loan repayment to a third-party lender for owner-arranged financing for qualified projects.12 Under the Wisconsin implementing statute, if an annual loan payment is in default, it becomes a lien on the property but only for the one-year period that is covered by the default.13 Liens under this implementing section have the same priority as a special-charge lien for other qualified public-improvement projects.14

Special requirements apply in situations in which the proposed energy-efficiency, renewable-energy, and water-efficiency improvements for the commercial property are expected to cost more than $250,000. First, an owner must obtain a written guarantee from the contractor that the improvement will achieve a savings to investment ratio of greater than 1.0. Second, the contractor under the written guarantee must annually pay the owner any shortfall in savings below this required level.15 The municipality has the authority to require a third-party technical review of the projected savings of the improvement as a condition of making a loan under the program for qualified projects that are valued at less than $250,000.16

Considerations in Applying PACE for Wisconsin Clients

Commercial Real Estate Lawyers. PACE financing provides several advantages over traditional financing for energy upgrades to existing commercial buildings. However, along with these advantages, there are certain challenges for the developer and its lawyer.

First, the developer likely will need consent from the existing mortgage lender before implementing a PACE project. Since lenders frequently have little first-hand experience with such projects, the developer’s lawyer should put together a supporting package seeking such lender consent.17 This supporting package should include the following:

- An explanation of the PACE financing program;

- A third-party report that outlines the efficiency upgrade goals, costs, and savings with anticipated payback periods for the proposed qualified project; and

- Examples of similar projects previously funded under PACE programs that contain metrics supporting the benefits of these projects (anticipated versus actual cost savings, payback periods, default rates, and so on).

This information will be useful for the existing banker when seeking authorization from the bank’s credit committee for consent to allow the PACE financing project to advance.

The PACE project size in relation to the existing building value is an important consideration in seeking existing lender approval. Minor projects (less than 5 percent of the value of the building) are likely to receive less scrutiny by existing lenders.18 However, proposed PACE projects that are more significant in size are likely to receive heightened scrutiny by the existing lender. For this reason, the supporting package is crucial and most likely the defining factor for the success of such proposed PACE-financed projects.

Lender Lawyers. With anything new in the financing world, it is difficult to be an early adopter. There will be challenges for both lenders and lawyers in the early stages of PACE implementation until they gain more experience with PACE projects. First, existing lenders only receive an indirect benefit of a more valuable collateral property enhanced by the qualified energy-or-water efficiency project. Second, the lender’s lack of experience with such efficiency projects can create an impediment in the approval process. Finally, lenders generally are reluctant to consent unless there is a strong and reliable supporting package justifying the proposed PACE project.19

From the perspective of the lender who is approached for financing PACE projects, there are also challenges. First, the lack of standardization in loan documentation creates impediments because there are more administrative costs to prepare the documentation necessary for early-stage PACE projects.20 Second, the PACE lender must justify the benefits of the project to the loan-approval committee.21 Once again, a reliable third-party project report prepared by the PACE applicant is crucial to the loan-approval process. As more experience is gained in this emerging area, transactional costs will be minimized with standardized loan documentation created for PACE financing projects.22

Although many lenders appear to be struggling with this new PACE financing structure, there are significant opportunities for these lenders and their lawyers. Providing lender consents for PACE projects is not necessarily a “value” proposition because the original lender/mortgage holder is essentially allowing another lender to finance a project on the property.However,for the consenting lender, funding PACE projects can be very profitable.23 The lending community should recognize the potential opportunities for these projects and consider the value proposition to fund these projects, especially in situations in which the PACE lender is also the underlying lender for the existing loan on a commercial project.

Municipal Lawyers. Municipal lawyers are key figures in PACE projects. In particular, municipal lawyers will craft ordinances designed to implement the PACE financing program. The terms and conditions contained in a municipality’s implementing ordinance will be the central factor for the future successes of the PACE financing program in that municipality.24

In considering adoption of a PACE implementing ordinance, the municipal attorney should keep in mind the following crucial factors. First, the city needs a mechanism that will lower administrative costs for lenders and building owners to participate. The municipality should provide an implementing guidance document as well as standardized lending agreements. These guidance documents can be used by interested parties to assess their potential participation.

Second, the city must consider a cost-effective mechanism for soliciting and obtaining existing lenders’ consents for the building owners’ participation in the PACE financing program. If a city can help provide financing solutions to an interested business owner, the cost of a PACE project could be reduced because timelines have been shortened for obtaining financing for these qualified projects.

Third, the city must select a cost-effective method to aggregate private or municipal funding sources. Generally, there are two funding mechanisms for PACE programs in commercial markets: public-financing programs (set up by the municipality), and private funding from approved sources of capital (banks or private-equity funds). If a public-financing option is used, the city will borrow the money from the capital markets through the issuance of bonds and make the proceeds available to the property owners for qualified upgrades.25

Finally, careful thought should be given to ensuring the efficiencies and cost saving promised for improvement projects.26 Frequently the mechanism for ensuring efficiency goals is a requirement for third-party certification of results expected for the proposed energy-efficiency-upgrade project.

Some strategies that the city should consider in meeting these challenges include the following:

- Provide a mechanism for third-party certification to assess the energy-efficiency performance of the proposed project.27

- Establish minimum performance standards that must be met before the proposed efficiency upgrade can be approved.28

- Establish recommended guidelines including benchmarks, past payment history, loan-to-value requirements, and projected cost-savings requirements.29

- Be cautious about encouraging use of PACE financing in vulnerable neighborhoods experiencing large declines in home prices.30

Conclusion

PACE financing provides many advantages over traditional lending mechanisms as a method to make energy and water use upgrades for commercial buildings a reality. The main impediment to its effective use in Wisconsin is the need for educating two audiences: existing lenders, whose consent to such projects is needed, and municipal officials, who must adopt implementing ordinances to authorize PACE programs. As this education occurs, PACE can be a valuable asset for financing effective energy-efficiency upgrades for Wisconsin’s commercial buildings.

Wisconsin lawyers have a crucial role to play in meeting these education requirements. Municipal lawyers can advise local governments about the benefits of incurring administrative costs for adopting and implementing a PACE ordinance, which will determine the success of the PACE program in their municipalities. Lenders’ lawyers also serve an important advisory role, assessing the benefits and risks of the PACE project for lending clients. Finally, attorneys for commercial-building owners who desire to participate in a PACE program will play an important role in advising owners on benefits and risks as well as documenting clients’ involvement in the lending transaction.

City of Milwaukee PACE Case Study

The city of Milwaukee has recognized the importance of encouraging energy efficiency and clean energy markets. Commercial PACE allows Milwaukee to support commercial development from the inside out, resulting in increased property values and an overall improved tax base. Commercial PACE will also help increase local economic activity for the area workforce as well as improve the city’s environment and general welfare.

Milwaukee’s Office of Environmental Sustainability has developed energy programs that offer solutions from small to large. The Milwaukee Energy Efficiency (Me2) program provides low-interest loans for residents and small-business owners (www.SmartEnergyPays.com). Additionally, the city’s solar program, Milwaukee Shines, provides low-interest solar loans and group purchase programs for residents (www.MilwaukeeShines.com). However, the city recognized the need to help larger building owners make deep energy retrofits or invest in larger solar projects that might not have a traditionally “quick” return on investment.

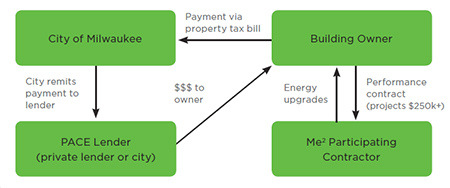

The city worked with interest groups and businesses to support the enacted state statute allowing for Commercial PACE projects. After the state law passed, the Milwaukee Common Council adopted an authorizing ordinance (Milwaukee City Ordinance § 304-26.5) that allows financing for commercial property energy improvements by levying a special charge on the property tax bill (see Figure 2).

The city places a portion of a debt owed by the property owner to a private lender before the owner’s property tax obligation to the city. The city will collect these special charges once they are levied on the tax bill and remit them to the lender when collected. However, in the event of foreclosure, the city receives all foreclosure proceeds and will pay the private lender only after the city receives full payment for all property taxes and other charges levied against the foreclosed property. To help sustain this program, the city collects a one-time administrative fee (0.5 percent of loan amount up to $5,000).

Eligible Properties and Projects.Milwaukee offers Commercial PACE for nonresidential properties and multifamily residential properties with more than four units. Property owners that owe the city money (that is, have delinquent property taxes) cannot participate, nor can owners of properties against which there are pending judgments. Milwaukee’s Commercial PACE program provides up to $100 million in loan capital to commercial building owners. Individual projects must be a minimum of $20,000 and maximum of $3 million in project size. The project cannot exceed 20 percent of total property value for most commercial properties, and the financing terms should not exceed the expected life of the proposed improvement. The city provides program guidelines and standard financing documents to aid building owners in developing a qualified project.

For projects estimated to cost less than $250,000, the property owner must submit a professional energy audit on the property that corresponds with the proposed improvements. For projects estimated to cost more than $250,000, an energy-savings-performance contract (for a minimum of three years) is required to meet state statute requirements as explained above. The performance guarantee should include annual estimates of savings so the guarantee can be evaluated annually for its accuracy.

Milwaukee’s first PACE financed project was launched in fall 2014 at the University Club of Milwaukee. The six-story building, built in 1928, will undergo a complete overhaul focused on generating 30 percent energy savings exceeding $1.3 million over 18 years.

Building a Milwaukee Workforce. Property owners participating in Milwaukee’s Commercial PACE program must use a qualified Me2 contractor. This ensures that the contractor meets certain required levels of insurance and training and will be able to offer Focus on Energy (a Wisconsin program) energy-efficiency and renewable-energy incentives to customers. Further, Me2 contractors working on Commercial PACE are required to meet certain labor standards. As part of the Me2 program, the city has adopted a community workforce agreement, which promotes hiring of city of Milwaukee residents and sound labor practices. Contractors must agree to use formerly unemployed or underemployed residents of the city (as defined by Milwaukee’s residential preference program) for a portion of the work. These additional requirements not only ensure quality work but also allow more Milwaukee residents to benefit from the city’s growing investment in energy efficiency and clean energy.

Energy Savings Made Public. Milwaukee also requires property owners that use PACE financing to participate in the EPA’s Better Buildings Challenge (http://city.milwaukee.gov/BBC), which requires property owners to commit to cutting energy use 20 percent by 2020. It provides free tools to track and manage energy use, while requiring building owners to disclose energy savings. The goal is for building owners to gain recognition for their energy saving efforts, attract tenants, and increase sales. So far, 10 Milwaukee private buildings, including the U.S. Bank building, BMO Harris headquarters, and the Milwaukee Athletic Club, plus the city of Milwaukee’s core government buildings are enrolled in the Better Buildings Challenge.

Figure 2

Milwaukee Commercial PACE Project Flow Chart

Endnotes

1 Short-Term Energy Outlook, U.S. Energy Information Administration, May 2014.

2 See www2epa.gov/carbon-pollution-standards/clean-power-plan-proposed-rule (June 2, 2014).

3 Lender Support Study, Enhancing the Commercial Real Estate Lender Consent Process for PACE Transactions, PACE Now (December 2012).

4 See http://pacenow.org/pace-programs.

5 Setting the PACE 2.0: Financing Commercial Retrofits, Institute for Building Efficiency (June 2014).

6 Wis. Stat. § 66.0627.

7 See Milwaukee Ordinance § 304-26.5.

8 See PACE Now Analysis Shows Growing Interest Among Banks in Financing Retrofits, Real Estate Law & Industry Report, Bloomberg Law (Dec. 25, 2014).

9 James M. Van Norstrand, “Legal Issues in Financing Energy Efficiency: Creative Solutions for Funding the Initial Capital Costs of Investments in Energy Efficiency Measures,” J. Energy & Environmental Law 2 (Winter 2011).

10 Property-Assessed Clean Energy (PACE) Financing of Renewables and Efficiency, National Renewable Energy Laboratory (July 2010).

11 Wis. Stat. § 66.0627.

12 Wis. Stat. § 66.0627(8)(a).

13 Wis. Stat. § 66.0627(8)(b).

14 Wis. Stat. § 66.0627(8)(c).

15 Wis. Stat. § 66.0627(8)(d).

16 Wis. Stat. § 66.0627(8)(e).

17 See VanNorstrand, supra note 9, at 9-10.

18 Id. at 12.

19 Id. at 13-14.

20 Id. at 11.

21 Id. at 9.

22 Id. at 13.

23 Id.

24 White House Policy Framework for PACE Financing Programs 2 (2009).

25 Id. at 2-3.

26 Id. at 5.

27 Van Norstrand, supra note 9, at 5.

28 White House Policy Framework, supra note 24, at 7.

29 Id.

30 Id.