April 28, 2016 – Attorneys will be able to get up to six continuing legal education (CLE) credits per reporting period for doing qualified pro bono work, under a petition that was recently adopted by the Wisconsin Supreme Court, subject to minor language changes.

April 28, 2016 – Attorneys will be able to get up to six continuing legal education (CLE) credits per reporting period for doing qualified pro bono work, under a petition that was recently adopted by the Wisconsin Supreme Court, subject to minor language changes.

The petition (15-05), filed by the State Bar of Wisconsin in 2015, also expands pro bono opportunities for Wisconsin-based in-house counsel attorneys who are “registered” with the Board of Bar Examiners (BBE), but do not possess a Wisconsin law license.

The court also adopted a so-called cy pres petition (15-06), submitted by the Wisconsin Access to Justice Commission, which will require a portion of unclaimed class action awards (residual funds) to be diverted to the Wisconsin Trust Account Foundation (WisTAF), which supports legal services to low-income and indigent persons.

The court adopted the petitions at its April 13 administrative conference, where it also revived a seven-year-old petition related to expunction and record retention issues.

Both petitions 15-05 (pro bono CLE/in-house counsel) and 15-06 (cy pres) are expected to take effect Jan. 1, 2017, after the court adopts final language and issues final orders.

Pro Bono CLE

A year ago, the State Bar’s 52-member Board of Governors unanimously approved petition 15-05, developed by the State Bar’s Legal Assistance Committee, which would allow attorneys in Wisconsin to obtain CLE credit for qualified pro bono work.

The State Bar noted that increasing pro bono work is one of the State Bar’s strategic priorities, a large number of Wisconsin citizens have unmet legal needs, and granting CLE credit for pro bono work would encourage more attorneys to volunteer.

Eleven other states, including Minnesota and Ohio, have adopted rules that grant CLE credit for pro bono work, a supporting memo to the State Bar petition noted.

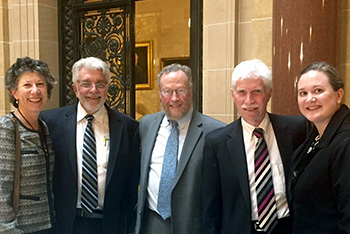

From left: U.W. Law Professor Marsha Mansfield (ATJ Commission), State Bar of Wisconsin President Ralph Cagle, Legal Action of Wisconsin Executive Director David Pifer, ATJ Commission President James Gramling, and Wisconsin Judicare Attorney Beth Ann Richlen (ATJ Commission). All appeared at the Wisconsin Supreme Court April 13 to support petitions that encourage attorneys to do pro bono work and increase access to justice in Wisconsin.

On April 13, numerous parties appeared at a public hearing to urge support, including State Bar President Ralph Cagle, Legal Action of Wisconsin Executive Director David Pifer, and Wisconsin Access to Justice (ATJ) Commission President James Gramling.

Gramling, a retired municipal court judge, said “more carrots are needed to provide incentives to busy lawyers who are committed to many other things.”

State Bar Pro Bono Coordinator Jeff Brown, who also appeared at the hearing, said “this is not a magic bullet” but “part of a larger system of incentives and rewards.”

Brown noted that the State Bar pays malpractice insurance premiums to cover attorneys who participate in State Bar pro bono programs. The State Bar also reimburses attorneys for out-of-pocket costs they incur on pro bono cases, provides training and support services, and presents annual awards for outstanding pro bono service.

The new pro bono CLE rule will allow attorneys to obtain CLE credit for “pro bono legal services” through a “qualified pro bono program,” which means a pro bono program operated by a nonprofit legal services organization that receives funding from WisTAF. Pro bono appointments from state or federal courts would also qualify.

Qualified pro bono programs also include a pro bono program operated by a Wisconsin law school, an existing pro bono program operated by a Wisconsin bar association, or a program approved by the Board of Bar Examiners as a “qualified pro bono program.”

Attorneys will be able to obtain one CLE credit for every five hours of pro bono service, capped at six credits (30 hours of pro bono work) for every two-year reporting period.

The supreme court adopted the proposal despite administrative and cost concerns raised by the BBE, which monitors compliance with CLE reporting requirements.

Expanded Pro Bono Opportunities for Registered In-House Counsel

A second element to approved petition 15-05 will expand pro bono opportunities for registered in-house counsel attorneys who are not licensed to practice law in Wisconsin.

The court approved this part of the petition, with several justices commending the efforts of corporate legal departments that are increasing pro bono efforts.

Currently, attorneys licensed outside the state but employed as lawyers in Wisconsin must register as in-house counsel under Supreme Court Rule (SCR) 10.03(f).

They can only provide legal services to their employers, including corporations, associations, or non-governmental organizations. Pro hac vice admission is necessary for a registered in-house counsel to appear in court or sign pleadings. There are approximately 300 registered in-house counsel lawyers in Wisconsin.

Under a comment to SCR 10.03, registered in-house counsel can provide pro bono legal services in Wisconsin only if the pro bono services are provided to “qualified clients of a legal service program in Wisconsin.”

The placement of the authorization in the rule comment and the narrower definition place limitations on registered in-house counsel who have skills that could benefit a wider range of pro bono clients.

With the final adoption of petition 15-05, registered in-house counsel will have clear authorization to do pro bono work and will not be restricted in the types of pro bono services they can provide. However, they will still need to obtain pro hac vice admission to appear in court or sign pleadings.

Because registered in-house counsel attorneys are not required to earn CLE credits in Wisconsin, the pro bono CLE rule does not apply to them.

Eve Runyon, now president and CEO of the Pro Bono Institute in Washington D.C., appeared at the court’s public hearing to urge support. She said more corporate legal departments nationwide are increasing pro bono efforts as corporations place an increased emphasis on corporate social responsibility and skills-based volunteerism.

“We call this the right to practice pro bono,” she said.

Runyon, who visited the State Bar to urge support a year ago, said 11 other jurisdictions in the last three years have changed pro bono rules to open new opportunities for registered in-house counsel, with 5,000 more lawyers obtaining authorization.

“In-house counsel, the Association for Corporate Counsel, legal departments, and chief legal officers all understand the importance of giving back, and want to make sure their lawyers can engage in pro bono just like other lawyers within a jurisdiction,” she said.

Michael Anderson, chief legal officer at CUNA Mutual Group, and Athenee Lucas, a nonresident member of the State Bar of Wisconsin and corporate counsel at Fiserv, both appeared at the public hearing to explain how the rule changes will help those companies expand pro bono opportunities for registered in-house counsel.

In a letter signed by more than two dozen of the chief legal officers for Wisconsin companies, the national Association of Corporate Counsel (ACC), and their Wisconsin chapter noted that formally recognizing “registered in-house lawyers as being able to provide pro bono services on equal footing with Wisconsin licensed in-house lawyers will help legal departments design pro bono programs open to all their lawyers.”

Cy Pres Petition

The State Bar of Wisconsin also supported the cy pres petition, approved unanimously April 13, which will funnel at least 50 percent of unclaimed residual class action funds to the Wisconsin Trust Account Foundation (WisTAF). WisTAF makes grants to legal service agencies that help low-income and indigent persons with civil legal needs.

Residual funds are funds that remain after payment of all approved class member claims, expenses, litigation costs, attorney fees and other approved disbursements.

A judge could order any balance, after minimum distributions to WisTAF, to be disbursed for “purposes that have a direct or indirect relationship to the objectives of the underlying litigation or otherwise promote the substantive or procedural interests of members of the certified class.”

Wisconsin Access to Justice Commission member David Harth, one of numerous parties that appeared at the court’s public hearing to urge support for petition 15-06, said this is one way to provide additional funding for those in need of civil legal services.

“I don’t think there’s any dispute that there is a large and growing need for legal services to low income and indigent Wisconsinites, that this need is not being met under current funding levels, and that the proposal before you today has the potential to provide much needed additional funding at no cost to the taxpayer,” Harth told the justices.

Proponents of the petition are hopeful that the state rule will provide a model for federal court judges who currently handle more class actions than state court judges.