Dec. 4, 2019 – Rising health insurance costs are a major concern to State Bar members, particularly those working in private practice. As you make your decisions on coverage before Open Enrollment closes on Dec. 15, 2019, consider the State Bar's new association health plan as one of your options for 2020.

According to the State Bar’s 2017 Economics of Law Practice survey, 35 percent of respondents working full time report that they are not covered by an employer-sponsored health insurance plan. In addition, 50 percent of respondents working in small private practice firms (of two to five lawyers) say they were unable to offer affordable health insurance coverage options or were not covered by an employer-sponsored health insurance plan.

The State Bar's new association health plan (AHP) is an option for members to consider as they review health care coverage needs for 2020. See more about it on WisBar.org. This new plan is the result of the work of the Insurance and Member Benefits Committee, which explores options to help members find affordable insurance coverage.

What Is the New Plan?

Changes to health plan regulations make it possible for the State Bar to offer an association health plan (AHP) to members.

This new plan is a fully insured, multiple-employer welfare arrangement (MEWA), with coverage provided by Wisconsin Physicians Service Insurance Corporation (WPS, WPS Health Insurance, Arise Health Plan, or WPS Health Solutions). In Dane County, coverage is provided by Quartz. Coverage under the plan is not available for employers outside Wisconsin, although coverage may be available when members travel outside Wisconsin.

This type of arrangement provides large-group coverage for small groups that band together. The plan is structured as a large-group plan, and is priced based on the specific characteristics and experience of the plan, not the Affordable Care Act small-group market.

Rates offered to each member group are determined by the insurer, based on the overall base rates for the plan in the region and characteristics and experience of the particular group. Law firms that are considered small groups (two or more employees) pool risk together and receive the rate benefits of a large group, independent of the small-group market.

Having a larger pool for risk-sharing purposes can benefit both small and large firms. The goal is to avoid large shifts in premiums from year to year. A larger group of participants helps the plan absorb the risks across a larger group and helps the plan operate more cost-effectively.

What Types of Firms and Businesses Qualify?

The plan is a group plan option that the employer offers to employees (attorneys and staff) and their eligible dependents. It is available to Wisconsin law firms with two or more employees that are considered employers under current AHP regulations.

Under current federal and state AHP regulations, the plan cannot cover:

-

State Bar members living outside Wisconsin;

-

individuals whose firm does not adopt the AHP;

-

individuals who do not participate in their firm’s employee group health plan; and

-

solo practitioners without nonfamily-member employees.

How Does It Work?

Employers are offered a variety of plans with a range of benefits and associated premiums. Employers select the plans appropriate for their offices.

Health insurance must be offered to all eligible employees – those working 26 or more hours per week. An employer contribution is recommended, but is not required to participate in the plan.

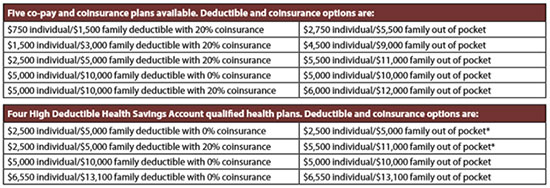

Based on the group size, a law firm may select up to four plans from the following options:

When Can Members Enroll in the New Plan?

The new AHP is available as an option for members to consider during the Nov. 1 to Dec. 15 open-enrollment period, for coverage beginning Jan. 1, 2020.

The State Bar is rolling out this new plan this month to allow members time to evaluate coverage in September and request rate quotes in October in advance of the open-enrollment period.

As with other plans, enrollment paperwork for coverage effective Jan. 1, 2020, must be submitted by Dec. 15, 2019.

Options for Your Insurance Needs

The State Bar of Wisconsin is committed to helping members find solutions to their insurance needs. For more information about the State Bar-sponsored association health plan, contact:

Professional Insurance Programs (PIP)

(800) 637-4676

info@profinsprog.com

www.insuranceformembers.com

Keep these health-related options in mind to address your health care needs:

- Group Dental Plan through Delta Dental

- EyeMed Vision Plan

- Coming soon: Critical Illness and Accident Coverage

For more information on these types of insurance, contact:

Bultman Financial Services, Inc.

(800) 344-7040 or (262) 782-9949

www.bultmanfinancial.com

Where Do I Get a Quote?

To work through your insurance needs or to secure a quote, contact PIP representatives:

Professional Insurance Programs (PIP)

(800) 637-4676

info@profinsprog.com

www.insuranceformembers.com

FAQs About the State Bar-sponsored Association Health Plan

Why is the State Bar offering an AHP?

Offering an association health plan (AHP) provides the opportunity for more affordable health coverage rates for State Bar members. An AHP allows for State Bar members with small law firms of two to 50 employees to pool together and have the advantages of a large employer for rating purposes.

The biggest advantage to offering an AHP is an even greater pooling or risk-sharing benefit. Having the benefit of a large group of participants helps the plan absorb the risks across a larger group and helps the plan operate more cost-effectively. The goal for any health plan is to avoid any large shifts in premiums from year to year. Having a large pool of participants will help accomplish this.

Who Provides Coverage for This Plan?

Coverage is provided by Wisconsin Physicians Service Insurance Corporation (WPS, WPS Health Insurance, Arise Health Plan, or WPS Health Solutions). In Dane County, coverage is provided by Quartz.

When is the Enrollment Period?

Open enrollment runs Nov. 1 to Dec. 15, 2019. This is an opportunity to review your current health coverage and see if the AHP results in a cost-savings for you. It’s another option to consider during your annual review. If you decide to switch coverage, you will need to have paperwork finalized through Professional Insurance Programs (PIP) by Dec. 15, 2019, to have coverage effective Jan. 1, 2020.

Who Can Join This Plan?

The State Bar-sponsored AHP is available to law firms in Wisconsin that are considered employers under current association health plan regulations. It is a group plan option for the employer of two or more employees to offer to its employees (attorneys and staff) and their eligible dependents.

Under current federal and state association health plan regulations, the plan cannot provide coverage to individual attorneys either working as solo practitioners without nonfamily employees, or as individual participants outside their firm's employee group health plan.

Can Sole Practitioners Participate?

Under current rules, a sole practitioner without non-family member employees cannot participate in Association Health Plans. Participation is limited to groups with two or more employees working 26 or more hours per week, not sole proprietors with no employees. Sole proprietors with no employees will need to secure their health coverage through the individual market or through another group plan available through a family member.

How Are Rates Determined? Will the Rates Be Competitive?

The plan is structured as a large-group plan, and priced based on the specific characteristics and experience of the plan. Rates offered to each member group are determined by the insurer, based on the overall base rates for the plan in the region and on the characteristics and experience of the particular group.

It is the goal of the plan to provide competitive rates with other small-group plan options available. However, the plan may or may not be the best option for a particular member group. Each member group will need to evaluate all of the options available to them to determine the best option.

Does the Plan Offer a Range of Options?

Yes; a variety of plans with a range of benefits and associated premiums are available. Each employer will select the most appropriate plans.

Who Do I Call to Get a Quote?

For more information on the State Bar association health plan, contact:

Professional Insurance Programs (PIP)

(800) 637-4676

info@profinsprog.com

www.insuranceformembers.com