On March 30, 2023, the Wisconsin Supreme Court issued an order amending the lawyer trust account rule, SCR 20:1.15, removing prohibitions on electronic transactions and providing lawyers greater flexibility in handling client funds. The newly amended SCR 20:1.15 will become effective July 1, 2023 (2023 Rule) and represents a major change in the regulation of lawyer trust accounts in Wisconsin.

Going forward, Wisconsin lawyers, like lawyers in most other jurisdictions, will be able to make electronic transactions into and out of their trust accounts without the use of additional specialized trust accounts, like the E-Banking Trust Account. Moreover, the new amendments to the rule do not prohibit lawyers from doing anything they are currently permissibly doing, so the amendments will not serve as a “gotcha” for those who are not timely aware.

Before addressing the implications of the new amendments to the trust account rule, it is helpful to review the landscape of electronic payments under the version of SCR 20:1.15 in effect from July 1, 2016, through June 30, 2023 (2016 Rule).

Electronic Transactions in the pre-July 2023 Trust Account Rule

The 2016 Rule had arguably the most restrictive prohibitions on electronic transactions in the United States.1 This was problematic both for lawyers and clients wishing to use modern banking methods for payment of legal fees and costs and to disburse funds from lawyer trust accounts for filing fees and other purposes.

Aviva Meridian Kaiser, Univ. of Buffalo 1979, is ethics counsel with the State Bar of Wisconsin. Ethics question? Call the

Ethics Hotline at (608) 229-2017 or (800) 254-9154.

Aviva Meridian Kaiser, Univ. of Buffalo 1979, is ethics counsel with the State Bar of Wisconsin. Ethics question? Call the

Ethics Hotline at (608) 229-2017 or (800) 254-9154.

Tim Pierce is ethics counsel with the State Bar of Wisconsin. Reach him by

email or through the

Ethics Hotline at (608) 229-2017 or (800) 254-9154.

Tim Pierce is ethics counsel with the State Bar of Wisconsin. Reach him by

email or through the

Ethics Hotline at (608) 229-2017 or (800) 254-9154.

Travis J. Stieren is the Trust Account Program administrator for the Office of Lawyer Regulation, Madison.

Travis J. Stieren is the Trust Account Program administrator for the Office of Lawyer Regulation, Madison.

Under the 2016 Rule, SCR 20:1.15(f)(2)c. prohibited third parties from making electronic transfers to or from a trust account. Also under the 2016 Rule, SCR 20:1.15(f)(3) prohibited lawyers from making electronic transfers as well, except that lawyers could make remote deposits provided the lawyer and financial institution keep appropriate records of each remote deposit.

The practical effect of these two provisions was that, under the 2016 Rule, lawyers could only disburse money from their trust account by paper check or wire transfer and clients and third parties could only pay money to trust accounts by cash, paper check, or wire transfer.

The 2016 Rule carved out two limited exceptions that allowed lawyers to engage in electronic transactions in their trust account.

The first exception in the 2016 Rule was found in SCR 20:1.15(f)(3)(b) and was known as the “E-Banking Trust Account.” This option required lawyers to keep two separate IOLTA trust accounts: the primary trust account and a second E-Banking Trust Account, which acts as a “pass through” account. A lawyer could both send and receive money electronically in the E-Banking Trust Account, but the lawyer had to disburse the funds to the regular trust account within three business days of availability.

In addition, the E-Banking Trust Account had to be an IOLTA account and was subject to all the other provisions of SCR 20:1.15, including the record keeping requirements of SCR 20:1.15(g). Thus, lawyers using this option had to incur the administrative costs of maintaining two trust accounts, including keeping two sets of trust account records.

The second exception under the 2016 Rule was found in SCR 20:1.15(f)(c) and known colloquially as the “All-in-One Trust Account.” This option allowed lawyers to maintain just one trust account and use it for all purposes, including electronic transactions, provided the lawyer complied with four additional security requirements.

First, the lawyer had to maintain commercially reasonable account security for electronic transactions. Second, the lawyer had to maintain a crime insurance policy or bond in an amount sufficient to cover the maximum daily account balance during the prior calendar year. Third, the lawyer had to arrange for all chargebacks, ACH reversals, monthly fees, and fees deducted from deposits to be deducted from the lawyer’s operating account, or the lawyer had to replace any and all funds withdrawn within three business days of receiving actual notice, and the lawyer had to do so prior to disbursing any funds from the trust account. Fourth, the lawyer had to record in the financial institution’s electronic payment system the date, amount, payee, client matter, and reason for each disbursement.

While the All-in-One Trust Account exception allowed lawyers to maintain just one trust account and one set of trust account records, the lawyer was required to maintain a potentially expensive crime insurance policy or bond. The one insurer that had worked with the State Bar of Wisconsin and the Office of Lawyer Regulation to develop a suitable crime insurance policy announced in 2022 it would no longer be writing or renewing any such policies, and lawyers have reported significant difficulty in finding other carriers willing to issue this specialized coverage.

Questions about the New Trust Account Rules?

Call the Ethics Hotline

State Bar of Wisconsin ethics counsel Tim Pierce and Aviva Kaiser can help answer your questions or resolve your ethics dilemma. The

Ethics Hotline in available Monday – Friday, 9 a.m. – 4 p.m., (608) 229-2017 or (800) 254-9154.

Alternative Protection for Advanced Fees

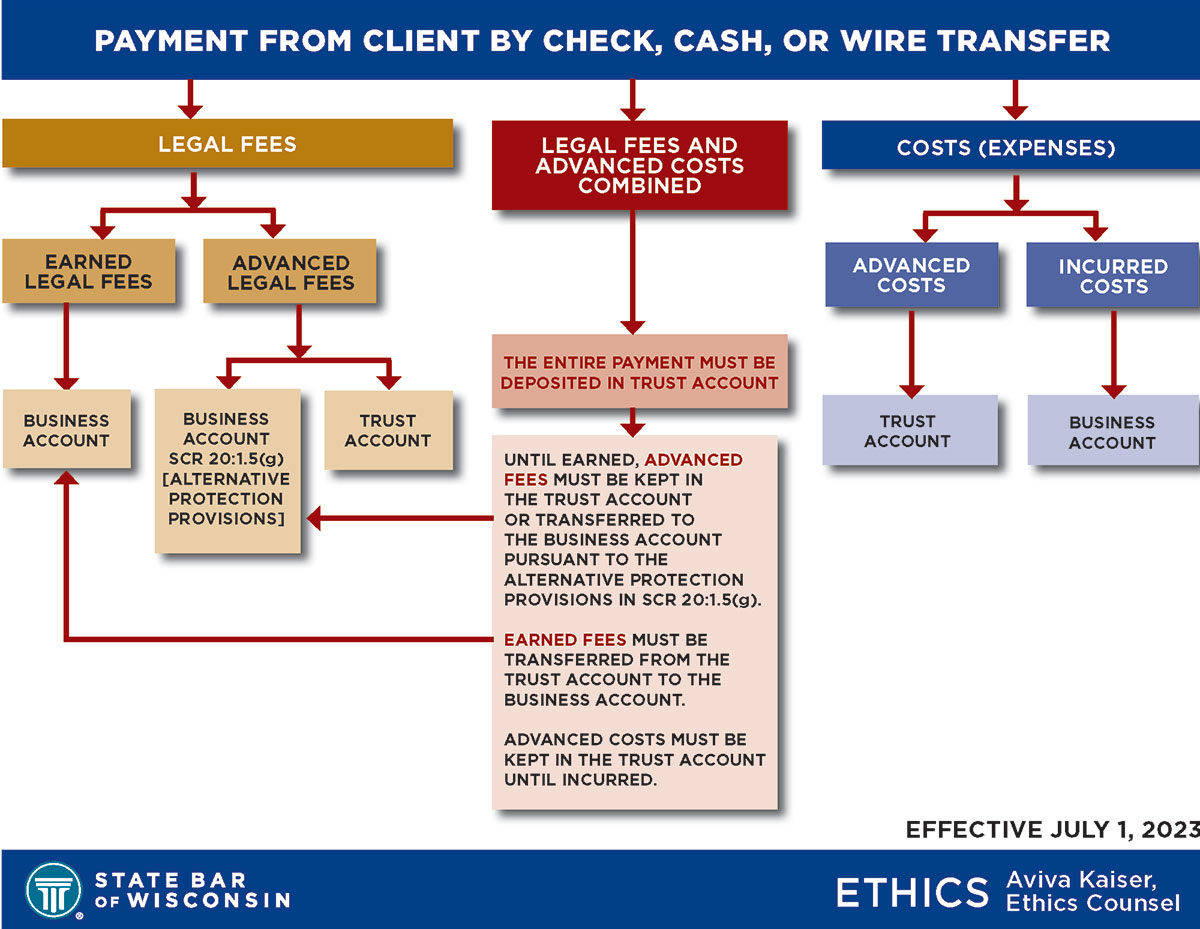

Aside from the two exceptions set out in the 2016 Rule, there was only one other method for lawyers to accept electronic payments for advanced fees: the “alternative protection for advanced fees” found in the fee rule, SCR 20:1.5(g). This option remains available under the 2023 Rule.

The alternative protection for advanced fees is the only exception to the general duty to hold client funds in trust under SCR 20:1.15(b)(1). It is limited to advanced fees only, and they must be paid directly to the operating account rather than the trust account. This option does not apply to cost advances, which must still be held in a trust account.

Under SCR 20:1.5(g), a lawyer may accept payments for advanced fees, including electronic payments, directly to the lawyer’s operating account rather than depositing the advanced fee into a trust account, provided that the lawyer’s fee is subject to review by a court of competent jurisdiction in the proceeding to which the fee relates, or the lawyer complies with all of the following requirements.

The new amendments to the rule do not prohibit lawyers from doing anything they are currently permissibly doing, so the amendments will not serve as a “gotcha” for those who are not timely aware.

To begin with, upon receiving an advanced fee, the lawyer must provide written notice to the client of the obligation to refund unearned fees, the availability of fee arbitration, and the availability of reimbursement by the Wisconsin Lawyers’ Fund for Client Protection, as well as other information relating to the rate of the fee and the anticipated expenses.

At termination of the representation, the lawyer must account for any fees not previously accounted for and promptly refund any unearned fees. The lawyer must also notify the client that, if the client disputes the fee and wants to arbitrate that dispute, the client must provide the lawyer with written notice of such dispute within 30 days of the lawyer’s mailing the accounting.

Upon receipt of timely notice that a client disputes the fee, the lawyer must either resolve the dispute or submit it to binding arbitration within 30 days, provided the client agrees to arbitration. Finally, once a lawyer receives notice of an arbitration award in the client’s favor, the lawyer must pay that award within 30 days.

The 2023 amendments to the trust account rule do not affect the SCR 20:1.5(g) alternative protection for advanced fees, which remains an option for accepting payment.

Changes to Electronic Transactions Effective July 1, 2023

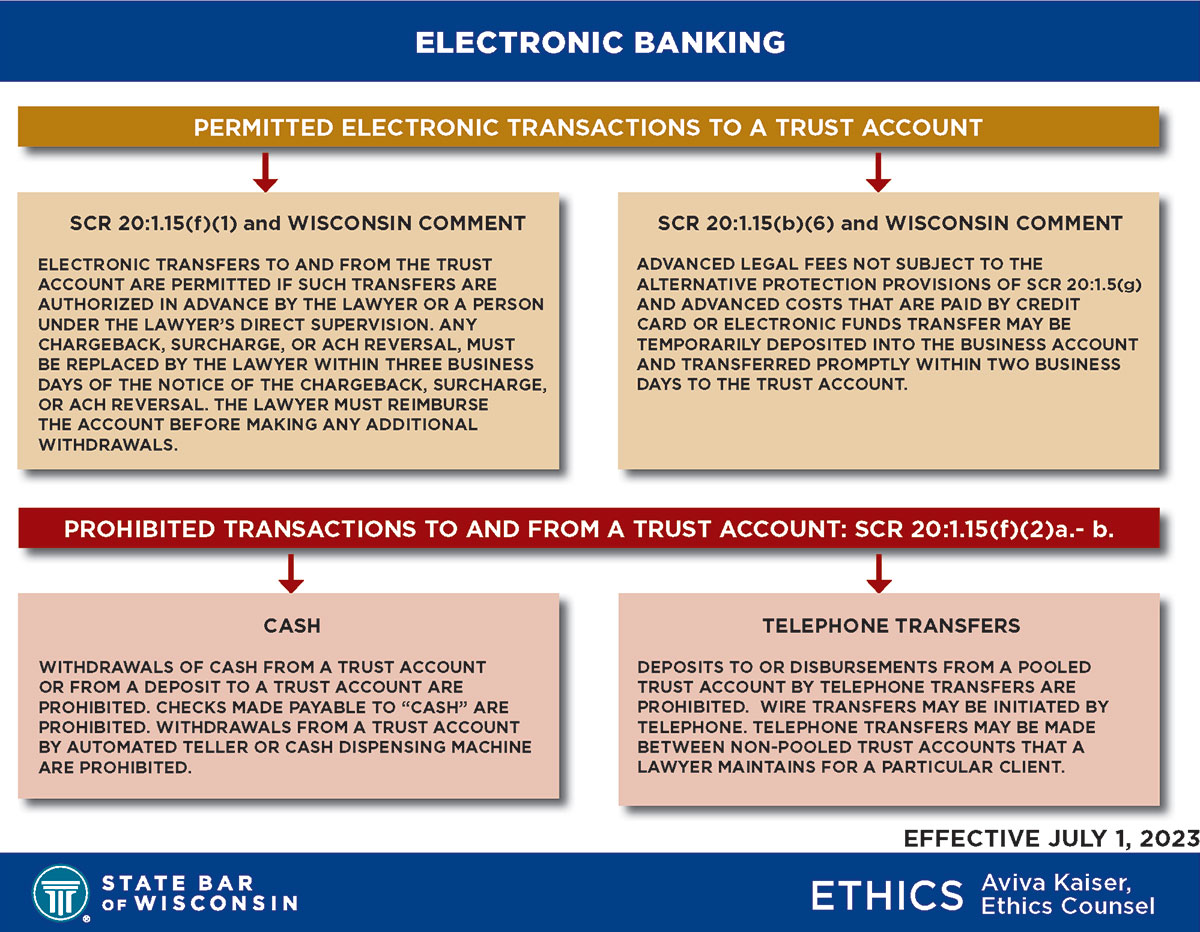

The most significant change to the trust account rule is the repeal of SCR 20:1.15(f)(2)c. and SCR 20:1.15(f)(3), which under the 2016 Rule prohibited third parties and lawyers from electronically transferring funds to or from a trust account. The result is lawyers will now be able to make electronic transactions in their trust accounts, and allow third parties to do so as well, so long as the other requirements of SCR 20:1.15 are followed.

To ensure the security of all transactions, electronic or otherwise, SCR 20:1.15(f)(1) has been amended as follows (amendments underlined):

“(f)(1)

Security of transactions. A lawyer is responsible for the security of each transaction in the lawyer’s trust account and shall not conduct or authorize transactions for which the lawyer does not have commercially reasonable security measures in place. A lawyer shall establish and maintain safeguards to assure that each disbursement from a trust account has been authorized by the lawyer and that each disbursement is made to the appropriate payee.

Every check, draft, electronic transfer, or other withdrawal instrument or authorization shall be personally signed or, in the case of electronic, telephone, or wire transfer, directed by one or more lawyers authorized by the law firm or a person under the supervision of a lawyer having responsibility under SCR 20:5.3. A lawyer shall reimburse the trust account for any shortfall or negative balance caused by a chargeback, surcharge, or ACH reversal by a financial institution or card issuer within three business days of receiving actual notice that a chargeback, surcharge, or ACH reversal has been made against the trust account; and the lawyer shall reimburse the trust account for any shortfall or negative balance caused by a chargeback, surcharge, or ACH reversal prior to disbursing funds from the trust account.”

Under SCR 20:1.15(f)(1), just as every paper check, wire transfer, or deposit must be authorized by a lawyer or someone under the direct supervision of a lawyer, each electronic deposit or disbursement must also be authorized by the lawyer or someone under the direct supervision of a lawyer.

Ideally, lawyers should maintain with their trust account records a written record of such authorization, be it in the fee agreement, a written receipt, or other written document.

As additional security, just as with All-in-One Trust Accounts, within three business days of receiving actual notice of a chargeback, surcharge, or ACH reversal by a financial institution or card issuer, the lawyer must reimburse the trust account for any shortfall or negative balance caused thereby. The lawyer must do so before disbursing any other funds from the trust account.

To avoid any unexpected shortfalls, lawyers should consider working with their card processing provider or other electronic payments processing service to ensure that all fees, reversals, and chargebacks are deducted from an account other than the trust account, such as the operating account.

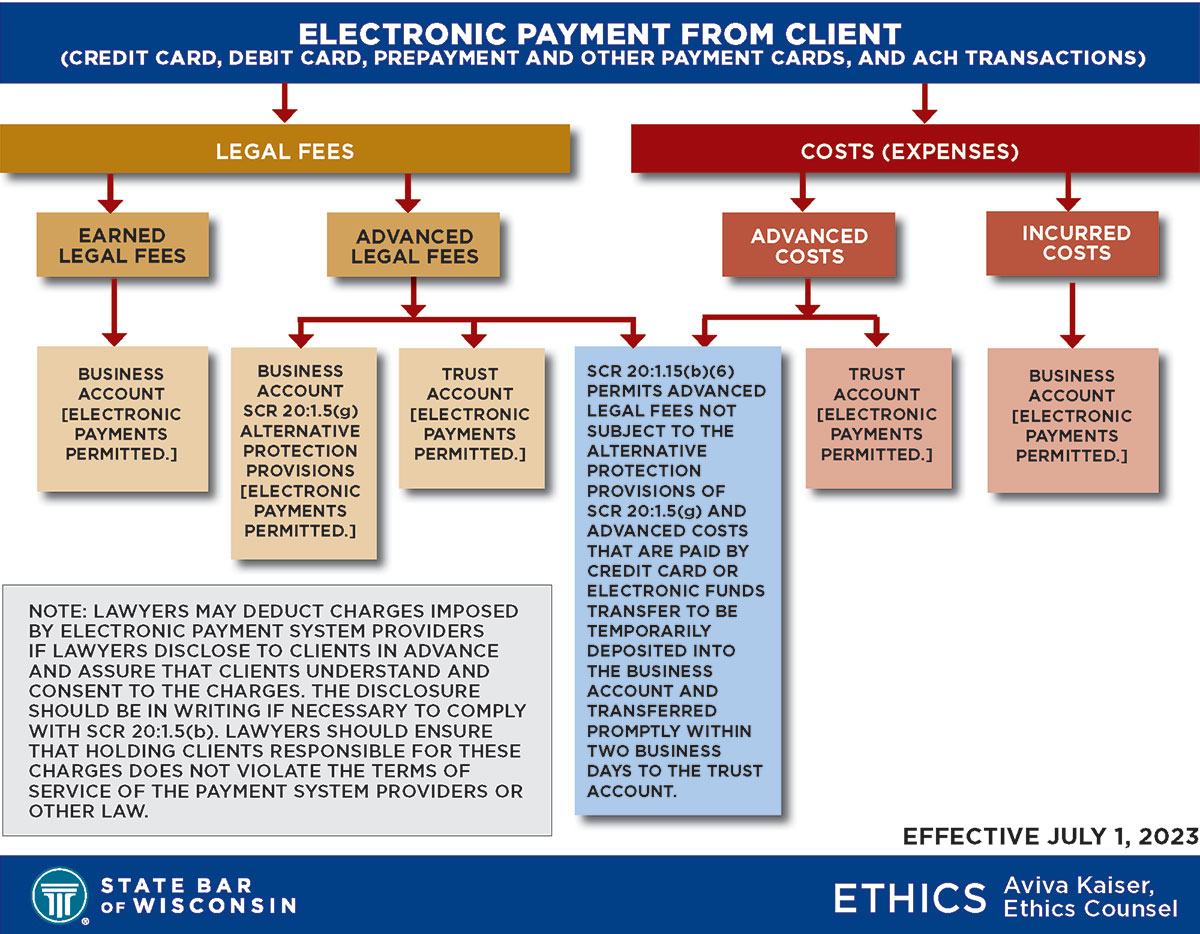

Beginning in 2007, lawyers could accept electronic payments into certain trust accounts under certain conditions. With some electronic payments, such as credit cards, costs in the form of transaction charges are often associated with such payments. Prior versions of SCR 20:1.15 (and SCR 20:1.5) did not clarify whether lawyers may hold a client responsible for such charges.

The 2023 comment to SCR 20:1.15(f)(1) clarifies that lawyers may hold clients responsible for these charges, provided that they disclose the practice to clients in advance and the client consents to the charges. The 2023 comment reads:

“Costs associated with electronic payments

“Electronic payment systems, such as credit cards, routinely impose charges on vendors when a customer pays for goods or services. That charge may be deducted directly from the customer’s payment. Vendors who accept credit cards routinely credit the customer with the full amount of the payment and absorb the charges. Before holding a client responsible for these charges, a lawyer should disclose this practice to the client in advance, and assure that the client understands and consents to the charges. This disclosure should be in writing if necessary to comply with SCR 20:1.5(b). In addition, the lawyer should ensure that holding the client responsible for transaction costs does not violate the terms of service of the payment system provider or other law.”

If the lawyer intends to make the client responsible for any portion of the service fees or charges associated with electronic transactions, such fees or charges become part of “the basis or rate of the fee and expenses for which the client will be responsible” under SCR 20:1.5(b)(1). Accordingly, the lawyer must provide advance written notice, preferably in the fee agreement, and obtain the client’s consent before doing so.

The final sentence of this comment cautions lawyers to confirm that passing on any service fees or charges to the client is permissible under the lawyer’s electronic payment processor agreement, as well as with any applicable federal, state, or local laws.

What Becomes of E-Banking Trust Account and All-in-One Trust Account?

The repeal of SCR 20:1.15(f)(3) also repeals those provisions relating to the E-Banking Trust Account and the All-in-One Trust Account. The revisions to the rule are permissive in nature. Lawyers and law firms that already have either of these two accounts may still use them. Electronic transactions are now allowed in any trust account, including existing E-Banking Trust Accounts and All-in-One Trust Accounts.

In the case of an existing E-Banking Trust Account, if a lawyer or law firm is satisfied having two trust accounts, one serving as their primary trust account and one as a “pass through” account for accepting and making electronic transactions, they may continue to do so. However, the lawyer or law firm also may close their E-Banking Trust Account and move to one single trust account.

With respect to an All-in-One Trust Account, this account should already be the lawyer’s primary trust account. Lawyers may continue to use it for all transactions, electronic or otherwise. Upon the repeal of SCR 20:1.15(f)(3)c., however, the extra security requirements for the All-in-One Trust Accounts are also repealed (though lawyers will be responsible for reversals, chargebacks, and fees, pursuant to amended SCR 20:1.15(f)(1), discussed above). The practical effect is that lawyers will no longer be required to maintain a crime insurance policy or bond to engage in electronic transactions.

Regardless of which account a lawyer chooses to use, they should continue to maintain reasonable account security for electronic transactions and record in the financial institution’s electronic payment system the date, amount, payee, client matter, and reason for any deposit or disbursement.

Newly Created SCR 1.15(b)(6) and Its Implications

The amended trust account rule creates new subsection, SCR 20:1.15(b)(6), which provides as follows:

“Advanced legal fees and costs. A lawyer shall deposit into a client trust account legal fees and expenses that have been paid in advance, to be withdrawn by the lawyer only as fees are earned or expenses incurred, except as follows:

“a. The lawyer complies with the requirements of SCR 20:1.5(g).

“b. The lawyer may accept credit card payments or electronic funds transfer payments of advanced legal fees and expenses as temporary deposits in a non-trust account, so long as such funds are transferred promptly, and no later than two business days following receipt, into a client trust account. However, except as provided by SCR 20:1.5(g), a lawyer shall not accept any advance payment into a non-trust account if the lawyer has any reason to suspect that the funds will not be successfully transferred into the client trust account within two business day of receipt.”

The implications of this new subsection are twofold. First, the 2016 version of SCR 20:1.15 made no reference to the SCR 20:1.5(g) alternative protection for advanced fees within the trust account rule. SCR 20:1.15(b)(6)a. rectifies this and clarifies that all advance payments for fees and costs must be held in the trust account until earned or incurred, unless the lawyer complies with the alternative protection for advanced fees under SCR 20:1.5(g).

Second, SCR 20:1.15(b)(6)b. creates a new option for lawyers to accept electronic payments for advanced fees and advanced costs into an operating account temporarily, so long as such funds are promptly transferred to the trust account within two business days following receipt. If the lawyer has any reason to suspect the funds will not be transferred to the trust account within two business days of receipt, then the lawyer shall not accept the electronic payment into the non-trust account.

This option allows lawyers to avoid the potential costs associated with maintaining two card processing services, one for the operating account and another for the trust account.

Instead, lawyers using SCR 20:1.15(b)(6)b. may maintain just one card processing service and have it attached to the operating account. Lawyers may use the operating account to accept electronic payments for advanced fees and costs, provided the funds are transferred to the trust account within two business days.

Under SCR 20:1.15(b)(6)b., the operating account is used solely as a means to accept an electronic payment. The funds must still be held in trust. Because the primary duty under SCR 20:1.15(b)(1) to hold in trust client and third party funds persists, any payments received electronically must be moved to the trust account and held there until such time as the fees are earned or the costs incurred.

This option should provide more flexibility for firms and sole practitioners to be able to use modern electronic banking methods, while minimizing the costs of doing so. In addition, using SCR 20:1.15(b)(6)b. will insulate the trust account from potential reversals, chargebacks, or other unexpected fees that may arise.

Tax Considerations for Electronic Transactions

Lawyers who choose to accept electronic payments should consider tax consequences. For example, 26 U.S.C. § 6050W requires credit card processors to report gross credit card transactions to the IRS on a Form 1099-K. This law does not distinguish payments made to an operating account from payments made to an IOLTA account. Payments for advanced fees and costs are reported together with payments for services already rendered. Therefore, amounts reported on the Form 1099-K will not necessarily reflect gross income actually received.

Further, 26 U.S.C. § 6050W imposes a 28% withholding penalty on all credit card transactions if the name of the lawyer or law firm used by the card processor does not exactly match the name associated with the federal employment identification number.

In light of these and other potential tax implications, lawyers should consider consulting a tax professional before accepting electronic payments.

Amendments to Other Rules and Comments

In addition to the changes to the rules regarding electronic transactions, the Wisconsin Supreme Court adopted other minor amendments as discussed below.

The court amended SCR 20:1.0(dm), the definition of “flat fee,” by adding a single sentence (underlined) to the definition:

“(dm) ‘Flat fee’ denotes a fixed amount paid to a lawyer for specific, agreed-upon services, or for a fixed, agreed-upon stage in a representation, regardless of the time required of the lawyer to perform the service or reach the agreed-upon stage in the representation. A flat fee, sometimes referred to as ‘unit billing,’ is not an advance against the lawyer’s hourly rate and may not be billed against at an hourly rate. Flat fees become the property of the lawyer upon receipt and are subject to the requirements of SCR 20:1.5, including SCR 20:1.5(f) or (g) and SCR 20:1.5(h), SCR 20:1.15(f)(3)b.4., and SCR 20:1.16(d).

Notwithstanding that lawyers have a property interest upon receipt of flat fees, such fees can be earned only by the provision of legal services.”

This sentence does not alter the definition, but clarifies the rule.

The statement that “flat fees become the property of the lawyer upon receipt” occasionally led lawyers to mistakenly believe that flat fees are

earned upon receipt. The only way fees may be earned is by providing legal services for which the fee represents payment, and unearned fees in the lawyer’s possession must be refunded upon termination of the representation.

See SCR 20:1.16(d).

This new sentence clarifies that a lawyer who receives an advanced flat fee must earn the fee by providing legal services. If the representation is terminated before completion, the lawyer must refund the unearned portion.

The court amended SCR 20:1.15(b)(1), again by the addition of a single sentence (underlined):

“Separate account. A lawyer shall hold in trust, separate from the lawyer’s own property, that property of clients and 3rd parties that is in the lawyer’s possession in connection with a representation. All funds of clients and 3rd parties paid to a lawyer or law firm in connection with a representation shall be deposited in one or more identifiable trust accounts.

Except as provided by sub. (b)(3), a lawyer shall not hold any funds in a trust account that are unrelated to a representation.”

Lawyers will now be able to make electronic transactions in their trust accounts, and allow third parties to do so as well, so long as the other requirements of SCR 20:1.15 are followed.

This sentence clarifies lawyers are not permitted to use their trust accounts for purposes other than the representation of clients, such as for the lawyer’s own purposes or to “hold” funds for a non-client friend or associate.

SCR 20:1.15(b)(3) prohibits lawyers from holding their own funds in a trust account except for nominal amounts to cover account services fees. Holding funds unrelated to a representation is generally prohibited by other rules, such as SCR 20:8.4(c). Thus, under prior versions of the rule, lawyers had to look elsewhere for a clear statement that a trust account is to be used only in connection with the representation of the firm’s clients.

The court also added a comment to SCR 20:1.15(j) to clarify that Wisconsin-licensed lawyers who practice in another jurisdiction may use a trust account that is compliant with the rules of that jurisdiction for Wisconsin matters:

“This rule does not prohibit a lawyer whose principal office is in another jurisdiction and who permissibly represents clients in Wisconsin matters from using a trust account for Wisconsin matters that is compliant with the rules of the other jurisdiction.”

Again, this is not a substantive change from the prior rule, but serves to clarify the language of the rule.

The 2016 Rule prohibited credit, debit, and other card payments in fiduciary accounts under SCR 20:1.15(k)(5)b., as well as cash transactions in fiduciary accounts under SCR 20:1.15(k)(5)a. The court deleted SCR 20:1.15(k)(5)b. and amended SCR 20:1.15(k)(5) to provide in its entirety:

“(5)

Cash transactions prohibited.

“No withdrawal of cash shall be made from a fiduciary account or from a deposit to a fiduciary account. No check shall be made payable to ‘Cash.’ No withdrawal shall be made from a fiduciary account by automated teller or cash dispensing machine.”

Just as the 2023 Rule permits electronic transactions in trust accounts, the 2023 Rule also permits electronic transactions, including card payments, in fiduciary accounts governed by SCR 20:1.15(k).

Conclusion

In sum, the amendments to the rules effective July 1, 2023, clarify existing duties relating to safekeeping client and third party funds and provide options for Wisconsin lawyers to use modern electronic banking transactions in the manner that best suits their needs.

Also of interest

State Bar Resources: Learn about Electronic Payments and Lawyer Trust Accounts

Visit WisBar Marketplace (marketplace@wisbar.org) for practical continuing legal education programs that provide detailed instructions on trust accounts, or focused programs that answer questions you may have, including the following.

Lawyer Trust & Fiduciary Account Basics 2023: A half-day program to explain how to properly hold client and third-party funds in connection with representation. Webcast seminar replays: June 13, 21, and 29; July 3, 11, 20, and 28; Oct. 25; and Dec. 8, 2023. Credits: 3.5 CLE, 3.5 EPR

Fee Agreements, Credit Card & Trust Account Obligations 2023: A half-day program to explain transaction fees, processing options, and how Supreme Court Rule changes in effect July 1, 2023, affect lawyer duties regarding trust accounts. Webcast seminar replays: June 14, 19, 23, and 27; July 5, 14, 20, and 31; Aug. 8 and 18; Oct. 30; and Dec. 14, 2023. Credits: 3.5 CLE, 3.5 EPR

Concrete Answers to Common Trust Account Questions 2023: Aviva Meridian Kaiser, Timothy Pierce, Christopher Shattuck, and Travis Stieren answer your questions. Webcast seminar replays: June 9, 20, and 28; and July 7 and 13, 2023. Credits: 2 CLE, 2 EPR

Ethical Requirements for Processing ACH, Wire Transfers & CC Payments 2023: Aviva Meridian Kaiser and Christopher Shattuck discuss these payment options. Webcast seminar replays: June 13, 23, and 28; and July 13 and 24, 2023. Credits: 1 CLE, 1 EPR

Fee Agreement Workshop: Supreme Court Rules & Recommendations 2023: Aviva Meridian Kaiser, Timothy Pierce, and Christopher Shattuck explain Supreme Court Rules on fee agreements and offer tips to avoid common mistakes. Webcast seminar replays: June 12, 20, and 28; July 7, 17, and 25; and Aug. 3, 2023. Credits: 2 CLE, 2 EPR

Visit

marketplace@wisbar.org for more information and to register.

Endnotes

1 For more information, see Timothy J. Pierce,

E-banking: Modernizing Trust Account Rules, 89 Wis. Law. __ (July/Aug. 2016),

https://www.wisbar.org/NewsPublications/WisconsinLawyer/Pages/Article.aspx?Volume=89&Issue=7&ArticleID=24966.

» Cite this article:

96 Wis. Law. 10-18 (June 2023).